In the turbulent tides of overseas commerce over the past year, U.S. negotiators landed a trophy bass in February: a trade agreement with Indonesia that we’ve been trying to hook for decades. It’s a big fish for dairy.

Following years of advocacy by NMPF and our partners at the U.S. Dairy Export Council and the Consortium for Common Food Names, the deal announced Feb. 19 will eliminate tariffs on all U.S. dairy exports, ease regulatory snarls and protect common cheese names like “parmesan.” Indonesia is already the eighth-biggest market for our dairy products — but it’s the world’s fourth most-populous nation, giving its growth potential for U.S. producers nowhere to go but up.

The Indonesia deal was the ninth trade deal secured to date by U.S. negotiators that includes new market access for U.S. dairy products. It’s a good one, but far from the only gain. Some other highlights of these pending agreements include:

- Elimination of 100% of tariffs on U.S. dairy products in most deals and notable tariff cuts in others, helping to provide competitive parity to suppliers from Oceania or the EU. A great example of this is the level playing field we now have for extended shelf-life milk into Taiwan.

- Bans on the introduction of dairy facility listing requirements in all these markets; in Indonesia this wipes away a process that could take over three years for a processing plant to navigate before it gained approval to ship.

- Commitments in each deal to protect U.S. exporters’ use of up to 40 common cheese names like “parmesan,” a result that’s particularly important as the European Union’s Free Trade Agreement network expands, threatening to limit U.S. growth opportunities to market cheeses with widely recognized terms.

This successful expedition would not have been possible without a world-class captain. Chief Agricultural Negotiator Julie Callahan was instrumental in securing these trade deals that will bring real results back to U.S. farmers. NMPF thanks her and the USTR team, all of whom we have had the honor of working with closely, for the substantial efforts made to bring these agreements home.

And even though a recent Supreme Court ruling on tariffs added even more uncertainty to trade policy, the progress made so far also underscores an important fact about dairy’s future: Trade continues to grow, and the foundations for future growth are only getting stronger, as bilateral negotiations continue and the dairy industry continues patiently building markets.

2025 was one of the strongest trade years ever for dairy products. Volume growth for U.S. dairy exports rose 4% over 2024 as measured in milk solids equivalent, ending up second only to 2022 in all-time shipments. Measured in value, U.S. dairy exports rose 15% over 2024 to $9.63 billion, just short of the 2022 record of $9.66 billion.

The star performer of the year? Cheese. Shipments in 2025 rose 20% over the previous year, which also set a record. New domestic processing capacity helped, as did growing familiarity with the quality and taste of American-made products. Just as impressive, the record sales were spread across the globe, lessening the risk that over-reliance on any single market could create risk in the future: In 2025, 39 countries bought more than 1,000 metric tons of U.S. cheese.

Butterfat and high-protein whey also saw banner years, showing the broad-based nature of sales growth. While conflicts between the U.S. and trading partners are throwing exports into doubt in some areas, in dairy, we’re not seeing widespread effects. In fact, it’s the opposite: U. S. dairy is highly competitive in the global marketplace, and we’re building stable, collaborative, relationships that we are confident will stand the test of time and contribute to long-term prosperity for U.S. dairy farmers.

We have a lot of folks to be thankful for on this journey, from our USDEC and CCFN colleagues to the cooperatives who provide high quality products and invaluable expertise. But looking ahead, we need to capitalize. At NMPF, a big part of our trade support comes from our NEXT (NMPF Exports & Trade) program, launched in the second half of last year.

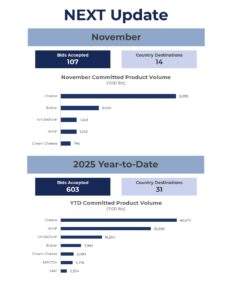

NEXT helps create export opportunities for U.S. dairy producers in international markets, by overcoming trade barriers and keeping domestic dairy products competitively priced overseas. The 142 million pounds of export volume it assisted in its half-year nearly matched the full-year 2024 volumes under the prior Cooperatives Working Together program, which NEXT succeeded.

The program continues to test innovative ways to grow dairy’s market share through new initiatives, including expanding its product mix and providing targeted, additional support beyond primary assistance in key markets — places where the U.S. is at a tariff disadvantage or the U.S. has the ability to gain market share. Cooperatives interested in joining NEXT, or wanting to know more about the program, should contact next@nmpf.org.

Improved trade access coming soon in numerous markets through bilateral agreements, a full year of NEXT, and the continued collaboration of dairy partners builds great momentum for 2026 in U.S. dairy shipments overseas.

Keep that in mind as you read about tariffs, tariff limitations, tariff alternatives, and trade tensions. Though the waters may not be calm, a skillful angler can still net an impressive haul. And thus far, we in dairy have been casting very effectively, and reeling in a brighter future for U.S. dairy products.

Gregg Doud

President & CEO, NMPF