Foreign Market Access & Development

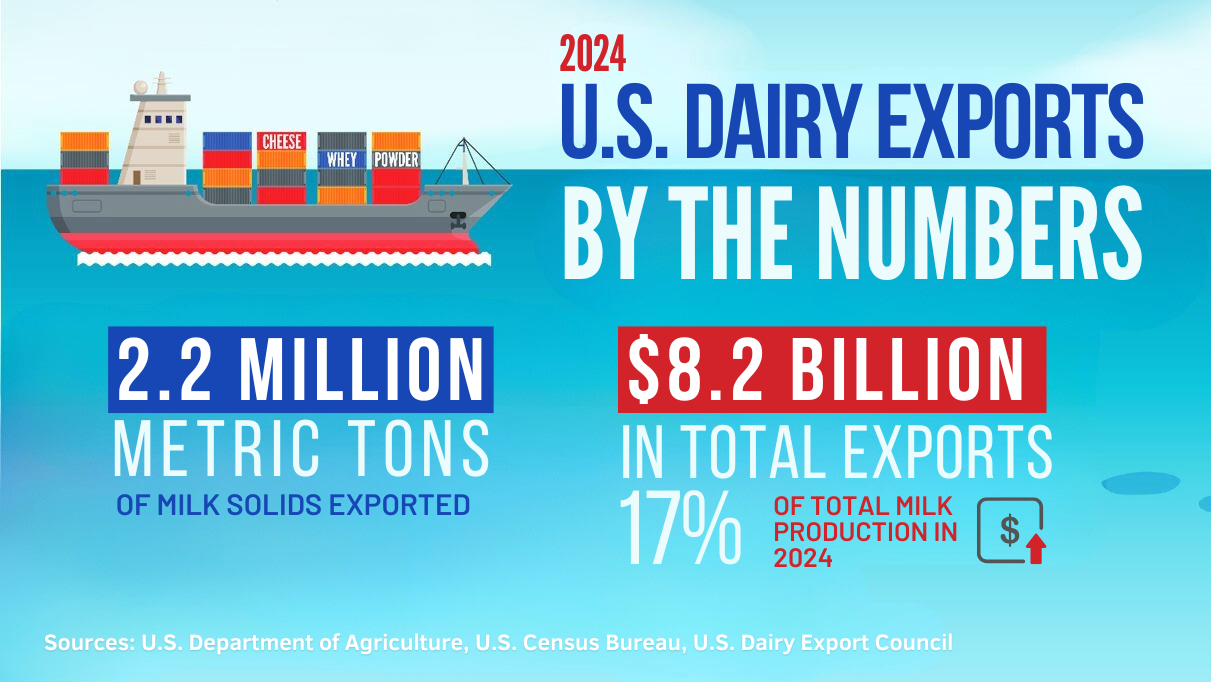

Exports are critical to the economic viability of U.S. dairy farmers. Today, one-sixth of all U.S. milk is sold commercially around the world in a broad spectrum of dairy products and ingredients. The world’s dairy needs continue to grow as regions with booming populations and growing economies consume more cheese, butter, and other dairy products. U.S. dairy farmers and their cooperatives are poised to meet this growing global demand.

When exports increase, the entire dairy supply chain benefits. U.S. trade agreements have played an indispensable role in increasing U.S. dairy exports. Trade agreements for decades have enabled U.S. dairy exporters to compete on a more level playing field with international competitors in terms of tariff access, removal of non-tariff barriers and clear and consistent rules for trade.

Maintaining trade relationships and expanding market access for U.S. dairy products is vital to the strength and continued growth of the domestic dairy industry. But the United States has failed to keep pace with competitors in Europe, New Zealand and Australia. U.S. dairy continues to fall behind as these competitors negotiate trade deals in growing foreign markets and erode U.S. export competitiveness. The U.S. government needs to take a proactive approach to tearing down both tariff and non-tariff barriers that hinder U.S. dairy exports.

Our Position

Together with the U.S. Dairy Export Council (USDEC), NMPF urges Congress and federal officials to work together to expand equitable trade relationships with key dairy trade partners and create greater market access for the high-quality milk and dairy ingredients manufactured by U.S. dairy farmers and their cooperatives.

NMPF and USDEC also strongly support the reauthorization of Trade Promotion Authority (TPA) to ensure the U.S. Trade Representative is provided with the tools necessary to negotiate trade deals and expanded market access for U.S. dairy products. To strengthen that guidance further, we urge additional clarity be included in TPA’s language regarding common name preservation.

Key Points

- U.S. dairy farmers are great at what they do and use innovative practices in animal care, nutrition, technology, and genetics to produce more milk, milkfat, protein, and lactose year-over-year. And despite steady growth in domestic dairy consumption, on-farm productivity gains continue to expand at a faster rate. Exports fill the gap and ensure market balance for U.S. dairy farmers.

- The case for expanded foreign market access goes beyond market balance. The international market is growing at a faster rate than the domestic market. U.S. dairy exports more than quadrupled on a milk solids equivalent basis since 2000, growing an average of 7 percent per year. Customers around the world continue to demand more high-quality, nutritious dairy products every year, a need that U.S. dairy farmers and their cooperatives are well positioned to meet.

- One out of every six gallons of milk produced by U.S. dairy farmers is turned into a dairy product shipped overseas. Every exported dairy product– whether it’s cheese, milk powder or another essential dairy ingredient – has a powerful impact across the entire supply chain.

- U.S. dairy exporters can compete on quality and price with dairy exporters throughout the world so long as there is a level playing field. But the tariff gap between the U.S. and our trade competitors is widening. Aside from the U.S.-Mexico-Canada Agreement update to NAFTA, the most recent new U.S. free trade agreements went into effect a decade ago.

- The international market has become increasingly important for enabling U.S. dairy farmers of all sizes and in all regions to continue growing. Greater access to key dairy markets where the U.S. is facing the challenge of competing at a disadvantage will mean continued opportunity and growth for U.S. dairy farmers.

More Information

- U.S. Dairy Trade Priorities for 2025

- NMPF and USDEC Comments Regarding Foreign Trade Barriers to U.S. Exports

- House Agriculture Subcommittee Testimony on U.S. Trade Policies and Priorities

- Comments Regarding Unfair Trade Practices and Non-Reciprocal Trade Arrangements

- Why Trade Agreements Matter: The Case for U.S. Dairy