The National Milk Producers Federation applauded the Senate Committee on Agriculture, Nutrition and Forestry for supporting by voice vote the Whole Milk for Healthy Kids Act, a vital piece of legislation for increasing student milk consumption and nutrition access.

The bill’s markup today is a critical step in passing this bipartisan legislation, which has already been approved at the House committee level.

“The Whole Milk for Healthy Kids Act is about making informed, science-backed decisions that prioritize the health and future of our children,” NMPF President and CEO Gregg Doud said. “We’re grateful that this common-sense legislation has received such strong support from both sides of the aisle. We commend Senators Marshall and Welch for authoring this bill in the Senate and advocating passionately for its passage, as well as Chairman Boozman and Ranking Member Klobuchar for their bipartisan leadership in moving the bill through committee. Passing the Whole Milk for Healthy Kids Act will allow more schoolkids to access essential nutrients in their diets, and that’s something everyone can get behind.”

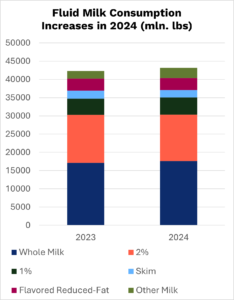

This bill, if signed into law, would provide schools with the option of serving whole and 2% milk. Whole and 2% milk are the most consumed varieties at home, more satiating than lower fat varieties and offer the same 13 essential nutrients including protein, calcium and vitamin D. Currently, school meal rules in effect since 2012 only allow 1% and fat-free milk options.

The bill is sponsored by Sens. Roger Marshall, R-KS, Peter Welch, D-VT, Dave McCormick, R-PA, and John Fetterman, D-PA. In addition, Chairman John Boozman, R-AR and Ranking Member Amy Klobuchar, D-MN, both strongly supported the bill as did many other committee members from both parties.

The House of Representatives is considering similar legislation led by House Agriculture Committee Chairman GT Thompson, R-PA, and Rep. Kim Schrier, D-WA. The House bill was approved by the House Education & the Workforce Committee with bipartisan support Feb. 12, and it now awaits floor action. The full House passed a similar bill in 2023, but that year’s session expired before Senate approval.

With today’s successful committee vote, the next step is floor action in both the House and the Senate. NMPF has a call to action on its website urging dairy advocates to speak up on the bill.