By Randy Mooney, Chairman, NMPF Board of Directors

We’ve had a lot of achievements this year, but it’s also been a challenging time.

We’ve had a lot of achievements this year, but it’s also been a challenging time.

A year ago, costs on the farm were extremely high, but we had prices that would cover that. This year, costs are still high, but prices are down. That’s a lot of stress on the farm. And we’re also dealing with problems that we’ve dealt with for years.

There are labor problems; you just can’t find anybody to work. Supply chain disruptions are closer to the farm this year. It’s milk trucks getting milk off the farm; it’s feed trucks bringing feed into the farm. It’s getting simple parts that we took for granted we could get anytime we wanted to. There are geopolitical issues and extreme weather events.

We have challenges all the time, but it just seems like we continue to have more. It seems like we’re in the eye of a storm. But as farmers, we always anticipate a moment before the dawn, before things turn, before things get good again.

One of the things I’ve learned is that a lot of the world is envious of what we have.

They’re envious because we have the Farmers Assuring Responsible Management (FARM) Program, a self-governing program. We have a government that recognizes what we’re doing with sustainability — it’s not being mandated down from the top.

We’re taking care of our own. Today, we produce more milk using fewer and fewer natural resources. We’re revitalizing rural communities. For every dollar generated in dairy farming, it turns over three to seven times in local communities, generating $750 billion in the United States. That‘s pretty impressive.

We’re nourishing families around the world through milk’s unbeatable nutritional value. I’ve dairy farmed for a long time, through good times and bad times, but there’s never been a time that I haven’t laid my head down on my pillow at night and been proud of what I accomplished on my farm. We’re putting the most nourishing, most nutritious product known to man in that milk tank. And when that truck leaves, I know I’ve done something good.

Our ability to evolve how we work and adapt our resiliency is becoming more and more important. This year, we came together as an industry to unite around issues that helped build that resiliency. NMPF worked with member co-ops, farm bureaus, and state dairy organizations to come to consensus on the most substantial issues. Even going back to 2021, when you talk about Federal Milk Marketing Order modernization, we’ve worked hard to get these things done. Nobody knows what the outcome’s going to be, but you telling your story has made a difference.

Beyond that, we’re going to get a farm bill passed — we’re going have an extension. We’ve been working to implement the next version of FARM, FARM 5.0, that goes into effect in July. We also will work on promoting dairy’s sustainable nutrition. Dairy offers the most complete nutritional package available, and what’s amazing is that as we produce more milk, we’ll continue to use fewer natural resources. That’s the definition of sustainable nutrition.

For years, we’ve talked about sustainability in terms of environmental stewardship and how that translates into financial value for farms. Now, the financial values are there. You take solar panels, wind, methane digesters, and a lot of things happen on a farm that’s generating electricity to run your farms and to run your neighbor’s households. We’re there now. What we need is conservation funding in the farm bill through USDA grants through state and federal programs. There’s real money available to help us continue to do that, and we will.

No imitation food from a nut, a bean, or grain can hold a candle to dairy’s nutritional package. We all know that. That’s why it’s important to keep fighting the fight on plant-based alternative labeling. In the guidance that was issued earlier this year, the Food and Drug Administration (FDA) recognized and admitted that plant-based alternatives are nutritionally inferior to real dairy.

Dairy protein plays a critical role in feeding people around the world, and it can’t be replaced by alternatives, including plant-based. Consumers have the right to understand how they’re nourishing their families, and we’re going to continue to advocate for the Dairy PRIDE Act to try to get that passed in Congress.

We’re going to continue to fight for more flavored milk in schools and higher fat levels, especially for those children whose main source of nutrition is through the school milk program. Milk is essential to their diets, and we’re not going to give up that fight. We’re all part of an industry that’s doing remarkable things. We are winning.

This has been adapted from Chairman of the NMPF Board of Directors Randy Mooney’s speech at the National Milk Producers Federation annual meeting in Orlando, Fla., on Nov. 14, 2023. This column originally appeared in Hoard’s Dairyman Intel on Nov. 22, 2023.

We’ve had a lot of achievements this year, but it’s also been a challenging time.

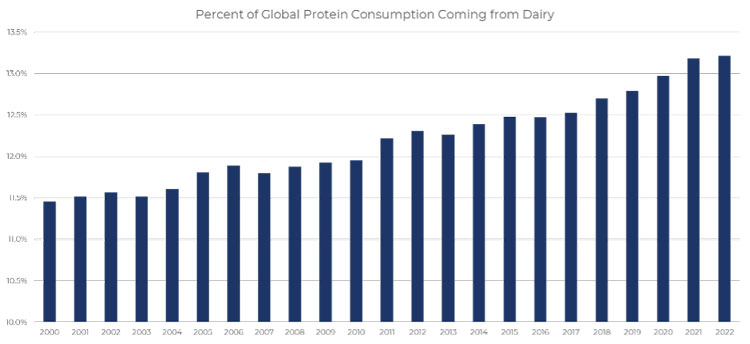

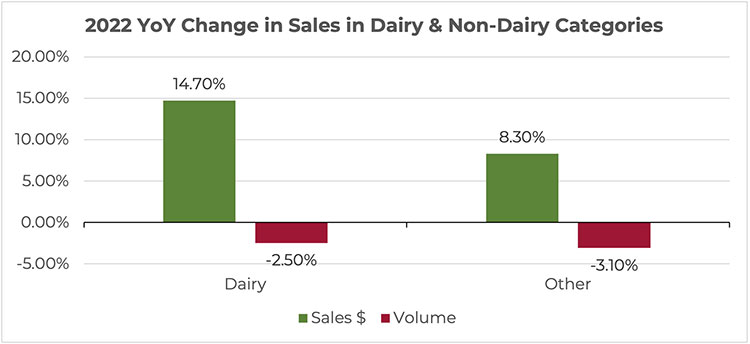

We’ve had a lot of achievements this year, but it’s also been a challenging time. U.S. dairy consumption has been steadily rising for years, reaching more than 11.5 million metric tons (milk solids equivalent) in 2022. This is up 15% from ten years ago. As one of the highest dairy consuming countries in the world, U.S. per capita consumption of cheese, yogurt, and butter has grown steadily for years. Recent food trends are bringing fun and innovative twists on common dairy products; as examples, butter boards went viral last year as a new “charcuterie” option, and health influencers are raving about the benefits of adding cottage cheese into recipes for higher protein and healthy fats. Ultimately, dairy demand remains resilient even when facing significant headwinds.Dairy’s resiliency is true on a global basis, too. On average, 13% of the global consumer’s protein came from dairy in 2022, a rise compared to 2021 and a significant leap over the past decade. In fact, global dairy protein consumption has grown by nearly 25% over the last decade.

U.S. dairy consumption has been steadily rising for years, reaching more than 11.5 million metric tons (milk solids equivalent) in 2022. This is up 15% from ten years ago. As one of the highest dairy consuming countries in the world, U.S. per capita consumption of cheese, yogurt, and butter has grown steadily for years. Recent food trends are bringing fun and innovative twists on common dairy products; as examples, butter boards went viral last year as a new “charcuterie” option, and health influencers are raving about the benefits of adding cottage cheese into recipes for higher protein and healthy fats. Ultimately, dairy demand remains resilient even when facing significant headwinds.Dairy’s resiliency is true on a global basis, too. On average, 13% of the global consumer’s protein came from dairy in 2022, a rise compared to 2021 and a significant leap over the past decade. In fact, global dairy protein consumption has grown by nearly 25% over the last decade.