Way back in the 1930s, one of the original motivations behind creating the Federal Milk Marketing Order system was to provide incentives for farmers to produce better milk. Much of the milk at the time was Grade B, which was lower quality than the Grade A milk earmarked for fluid consumption. To ensure an adequate supply of higher-quality milk, the FMMO system set up pricing that encouraged its production.

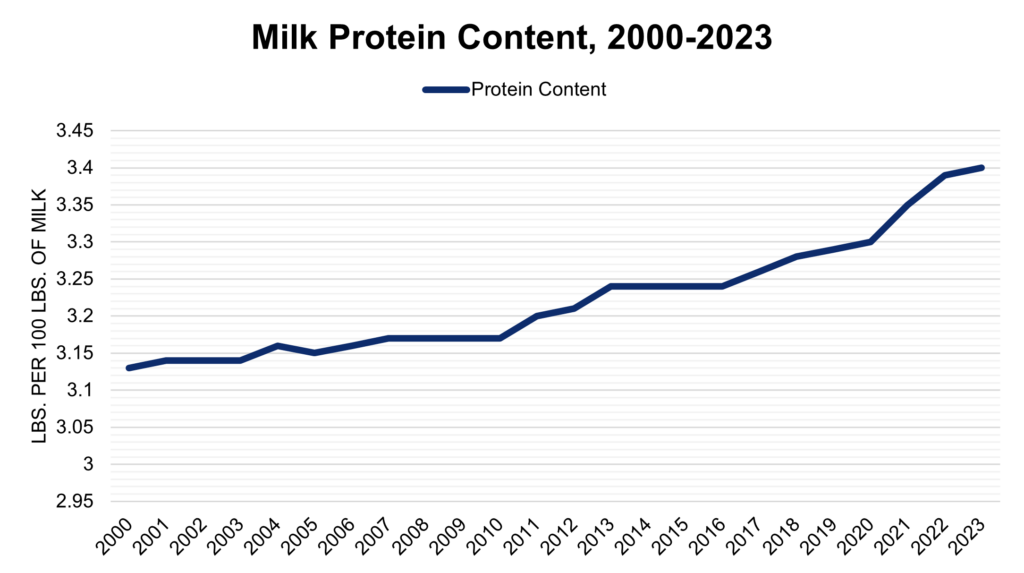

It worked. U.S. milk production is now almost entirely Grade A – even for uses in which Grade B is permissible, such as in certain manufactured dairy products. And in the past quarter century, better animal care, and better science and technology, has improved milk even more in terms of its nutrition, its quality and its premium-value components. For one example – take a look at how the percentage of protein in 100 pounds of milk has evolved since 2000.

Impressive. And just like in the 1930s, it has to do with incentives. The adoption of multiple component pricing in 2000 paid farmers for the protein content in most of their milk, just as they had long been paid for its milkfat content.

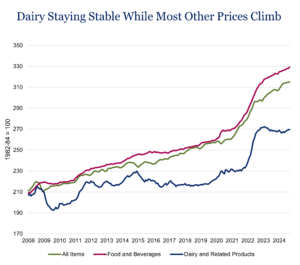

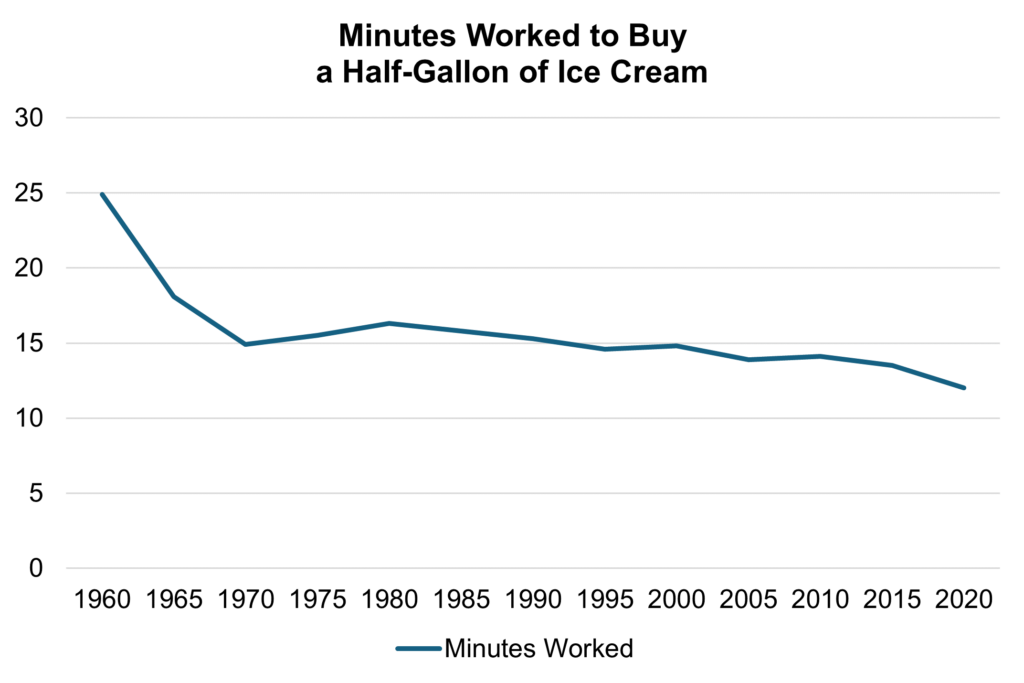

That’s the good news. But the bad news is that in many other ways, federal order pricing formulas that often haven’t changed since 2000 don’t reflect the structure of today’s dairy industry. And that disrupts those incentives, to the detriment of everyone who holds a stake in dairy’s success.

For example, Class I differentials – designed to ensure that processors receive an adequate supply of fresh milk to produce fluid milk products – haven’t been updated nationwide since 2000. Make allowances in the federal order product price formulas – which are supposed to cover the cost of converting raw milk components into finished products – have also gone a generation without adjustment, hindering processors that farmers need to thrive.

Simply put, dairy as an industry can’t thrive without adequate updates to federal formulas. So hooray for protein. But many current formulas still don’t work for farmers and the cooperatives they own. The improved quality and availability of American milk comes from farmers’ hard work. And good work should be rewarded.