Today’s ruling by a U.S-Mexico-Canada Agreement (USMCA) dispute panel allowing Canada to restrict the dairy access that the United States negotiated for in the USMCA pact weakens the agreement’s value to the US dairy industry, according to the National Milk Producers Federation and the U.S. Dairy Export Council.

An earlier panel ruled in January 2022 that Canada had improperly restricted access to its market for U.S. dairy products. In response, Canada made insufficient changes to its dairy tariff rate quota (TRQ) system, resulting in an outcome that still fell far short of the market access the U.S. expected to receive under USMCA. To address that shortcoming, the U.S. brought a second case to challenge the changes that Canada instituted. Today the panel announced that Canada was not obligated to make further changes.

“It is profoundly disappointing that the dispute settlement panel has ruled in favor of obstruction of trade rather than trade facilitation,” said Jim Mulhern, president and CEO of NMPF. “Despite this independent panel’s adverse ruling, we’d like to thank the Biden Administration and the many members of Congress who supported us for their tireless pursuit of justice for America’s dairy sector. We urge Ambassador Tai and Secretary Vilsack to look at all available options to ensure that Canada stops playing games and respects what was negotiated.”

Since the U.S. Trade Representative initially launched the first dispute settlement case against Canada in 2021, USDEC and NMPF have worked with USTR, USDA, and Congress to try to secure full use and value of USMCA’s dairy TRQs for American dairy producers and processors.

“By allowing Canada to ignore its USMCA obligations, this ruling has unfortunately set a dangerous and damaging precedent,” said Krysta Harden, president and CEO of USDEC. “We do however want to express our appreciation for allies in Congress and the Administration for their efforts and commitment to fighting for U.S. dairy. This is unfortunately not the only shortcoming in Canada’s compliance with its international commitments. We are committed to working with USTR and USDA to evaluate efforts to address Canada’s continued harmful actions that depress dairy imports while simultaneously evading USMCA’s dairy export disciplines.”

When first implemented in 2020, USMCA established 14 different TRQs, which allow a predetermined quantity of imports at a specified low tariff rate. The TRQ system that Canada implemented awarded the vast majority of TRQ volumes to Canadian processors and granted very limited access to TRQs to distributors – resulting in limited market access for U.S. exporters. Minor modifications to that system made in 2022 have continued that imbalanced approach.

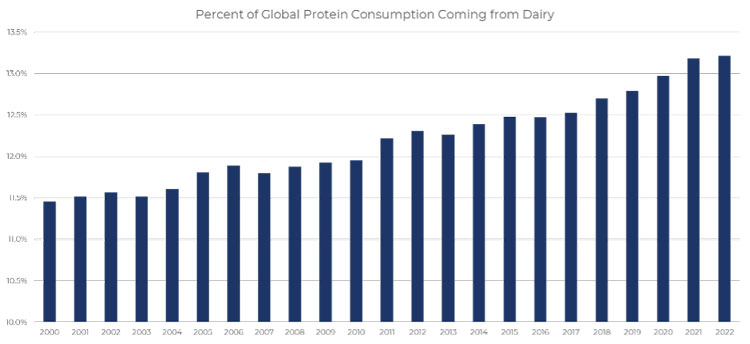

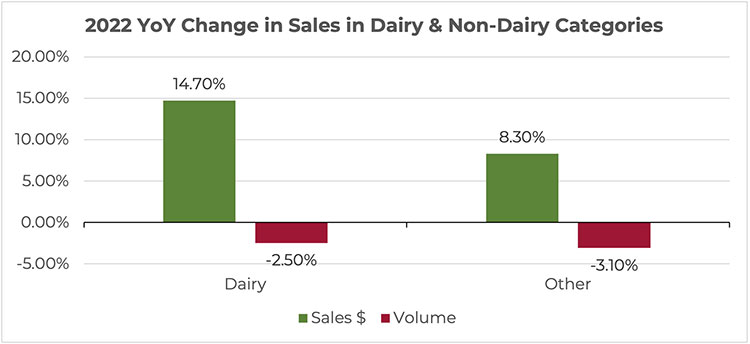

U.S. dairy consumption has been steadily rising for years, reaching more than 11.5 million metric tons (milk solids equivalent) in 2022. This is up 15% from ten years ago. As one of the highest dairy consuming countries in the world, U.S. per capita consumption of cheese, yogurt, and butter has grown steadily for years. Recent food trends are bringing fun and innovative twists on common dairy products; as examples, butter boards went viral last year as a new “charcuterie” option, and health influencers are raving about the benefits of adding cottage cheese into recipes for higher protein and healthy fats. Ultimately, dairy demand remains resilient even when facing significant headwinds.Dairy’s resiliency is true on a global basis, too. On average, 13% of the global consumer’s protein came from dairy in 2022, a rise compared to 2021 and a significant leap over the past decade. In fact, global dairy protein consumption has grown by nearly 25% over the last decade.

U.S. dairy consumption has been steadily rising for years, reaching more than 11.5 million metric tons (milk solids equivalent) in 2022. This is up 15% from ten years ago. As one of the highest dairy consuming countries in the world, U.S. per capita consumption of cheese, yogurt, and butter has grown steadily for years. Recent food trends are bringing fun and innovative twists on common dairy products; as examples, butter boards went viral last year as a new “charcuterie” option, and health influencers are raving about the benefits of adding cottage cheese into recipes for higher protein and healthy fats. Ultimately, dairy demand remains resilient even when facing significant headwinds.Dairy’s resiliency is true on a global basis, too. On average, 13% of the global consumer’s protein came from dairy in 2022, a rise compared to 2021 and a significant leap over the past decade. In fact, global dairy protein consumption has grown by nearly 25% over the last decade.