Tag: milk prices

Record Exports Show Dairy’s Global Reach; Cheese Demand Rises

Exports Buoy Dairy as Inflation Erodes Domestic Demand

Falling Prices, Rising Opportunities on Tap for 2023

Record milk prices seen in 2022 likely won’t repeat themselves, as production increases and consumers grapple with an economic slowdown, according to members of the NMPF and U.S. Dairy Export Council’s joint economics unit, in a Dairy Defined Podcast released today. But exports are on track to increase, and demand will likely be resilient as dairy remains must-have for buyers.

“Consumers around the world still gravitate towards dairy, even when they’re experiencing tighter economic situations,” said Will Loux, head of the team Vice President for Global Economic Affairs with NMPF and USDEC. “They ultimately view dairy as an essential item and will continue to consume it.”

Loux discusses the global and domestic dairy outlook with NMPF’s Chief Economist, Peter Vitaliano; Economic Research and Analysis Director, Stephen Cain; and the joint economic team’s newest member, Economic Policy and Global Analysis Coordinator, Allison Wilton. The full podcast is here. You can also find the podcast on Apple Podcasts, Spotify and Google Podcasts. Broadcast outlets may use the MP3 file below. Please attribute information to NMPF.

Rising Domestic Use Supports Prices

No DMC payments for October as Prices Rise

The U.S. average all-milk price rose $1.50/cwt in October from a month earlier, boosting the month’s DMC margin well above the $9.50/cwt maximum coverage level needed to trigger program payments, after two months of payouts.

The October margin was $10.71/cwt, $2.09/cwt higher than September’s margin. The DMC feed cost dropped by $0.59/cwt in October, driven entirely by a sizeable drop in the price of corn.

Another small payment for $9.50/cwt Tier 1 coverage may be triggered in December, based on current projects. Payments this year under the program, for August and September, together total the equivalent of about $0.19/cwt on an annualized basis and would be enough to cover the annual premium for a farmer enrolled in DMC at the $9.50 coverage level.

NMPF’s Galen on DMC Signup

NMPF Senior Vice President Chris Galen reminds farmers of the upcoming Dec. 9 deadline to enroll in the Dairy Margin Coverage Program in an interview with the National Association of Farm Broadcasters. This year’s payments under the program — the result of high input costs eating into record prices — show the wisdom of DMC’s design, Galen said. “As we head into 2023, we know that milk prices aren’t going to be as strong,” Galen said. “We know that input costs are still going to be significant.”

Cheese Sales Drive U.S. Dairy Consumption Growth

China’s Dairy Demand May Be Sluggish in ’23

By Stephen Cain, Director of Research and Economic Analysis, NMPF.

Outside of cheese, China is the number one importer of essentially every major dairy product. Globally, the world’s most populated country purchases 27% of all traded dairy products on a milk solids basis. China accounts for roughly 20% of all U.S. dairy exports and nearly half of all U.S. dry whey exports.

Outside of cheese, China is the number one importer of essentially every major dairy product. Globally, the world’s most populated country purchases 27% of all traded dairy products on a milk solids basis. China accounts for roughly 20% of all U.S. dairy exports and nearly half of all U.S. dry whey exports.

All of this makes China an unquestionably important market; yet, over the last year, Chinese demand has been down significantly. Chinese milk solids imports over the last 12 months are down 16%, and they’re heavily down in skim milk powder (-20%), dry whey (-17%), and whole milk powder (-24%). Two key pieces that have led to the pullback are high stockpiles and COVID-19 lockdowns.

Following the onset of the pandemic and wanting to ensure adequate supplies on hand, China built up some impressive stocks, especially in skim milk power and dry whey. From mid-2020 through mid-2021, Chinese milk solids imports climbed 32% over the preceding 12 months. For the same time period, skim milk powder and dry whey imports rose 32% and 50%, respectively.

This high purchase volume outpaced demand and led to stock build up. These high stocks, coupled with then-high global prices, led China to pull back from the global market and instead work down its stockpiles. That largely kept Chinese purchasing depressed over the past year. Encouragingly, stocks are now approaching more normal levels, which supports China returning to the market, especially for skim milk powder and dry whey.

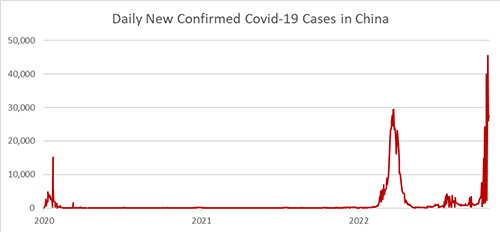

More COVID-19 lockdowns throughout China are also plaguing demand. While the rest of the world moves on from the pandemic and reverts to pre-COVID-19 life, China seems to be charging in the opposite direction. The zero-COVID policy in China has led to extreme measures in the country, with huge swaths of the population being locked down as the country continues its losing battle against the disease.

Earlier this year, Shanghai, the largest city in China with roughly 25 million residents, was put in lockdown for two consecutive months. Since then, lockdowns have only increased in number and severity, with some estimates as of late October stating there were more than 200 million people affected by lockdowns nationwide.

While many agree China relaxing its zero-COVID approach would be beneficial, rising cases in the country suggest that’s unlikely to occur. The country is facing the highest rate of new cases since the start of the pandemic, which means lockdowns and tough restrictions are only going to become more commonplace. That’s hitting dairy demand. Restaurants and the food service sector are hugely important to dairy consumption in China, but that consumption avenue is being restricted as consumers are increasingly unable to leave their homes. Until lockdowns and restrictions ease, Chinese dairy demand will continue to be challenged.

Dairy is only one part of a Chinese economy that’s facing headwinds. A limited gross domestic product (GDP) growth outlook, a teetering real estate sector, and depressed, COVID-19-driven demand from lockdowns are creating a challenged economic outlook. The 2022 GDP forecast is estimated at 3.2%, which would make for one of the worst performances in nearly half a century; 2023 looks only slightly better, with forecast growth of around 4.4%.

Similarly, Chinese dairy demand in 2023 is likely to see similar sluggish growth. Despite the melancholy economic outlook and lockdown projections, Chinese imports in 2023 will likely be up, but not at substantial volumes, and certainly not same at the growth rate we saw in 2021. As stocks are depleted and domestically produced products (which are largely more expensive than imports) fail to meet demand, China will have to return to the global market. The biggest swing factor, though, remains COVID-19 lockdowns. If China doubles down on lockdowns, demand will likely continue to be depressed and imports will be challenged. Should they ease, China will certainly need product, and greater imports will follow — and that would be good news for U.S. exporters.

This column originally appeared in Hoard’s Dairyman Intel on Nov. 28, 2022.

NMPF’s Bjerga on the Congressional Elections and Dairy’s Challenges

NMPF Senior Vice President of Communications Alan Bjerga details some of the policy and marketplace challenges U.S. dairy is striving to meet, regardless of the cloudy outcomes of Tuesday’s congressional elections, in an interview with RFD-TV. Opportunities to grow markets via sustainability, an adequate safety net in the upcoming farm bill, and sensible industry regulation all loom in 2023, with dairy well-positioned to make progress.

NMPF Unanimously Endorses Marketing Order Modernization Plan in Annual Meeting

National Milk Producers Federation (NMPF) leadership unanimously endorsed a proposal to modernize the Federal Milk Marketing Order milk-pricing system at its annual meeting in Denver, which concludes tomorrow. It also welcomed new directors — as well as a new member.

“Dairy is positioned to be a trusted anchor in an uncertain world,” said NMPF Chairman Randy Mooney in remarks at the meeting, part of a joint event held by NMPF, the National Dairy Promotion and Research Board and the United Dairy Industry Association. “Together we can seize opportunities to feed the world. Our product is one of the most nutritionally valuable foods available. We create vibrant rural communities that keep America strong by helping to retain local schools, build energy independence, preserve the environment, and ensure food security for everyone.”

Central to discussions was recommendations developed on federal milk pricing after more than 100 meetings that have taken place over the past year. NMPF’s Board of Directors endorsed a proposal that:

- Returns to the “higher of” Class I mover;

- Discontinues including barrel cheese in the protein component price formula;

- Extends the current 30-day reporting limit to 45 days on forward priced sales on Nonfat Dry Milk and dry whey to capture more exports sales in the USDA product price reporting;

- Updates milk component factors for protein, other solids and nonfat solids in the Class III and Class IV skim milk price formulas;

- Develops a process to ensure make-allowances are reviewed more frequently through legislation directing USDA to conduct mandatory plant-cost studies every two years; and

- Updates dairy product manufacturing allowances contained in the USDA milk price formulas.

NMPF continues work on the Class I milk price surface as it examines information on county-level Class I price differentials. That work is expected to be completed later this year. Any final proposal will be reviewed by the organization before it’s submitted to USDA to be considered for a federal order hearing.

“We have made tremendous progress and are moving forward with the strong level of consensus in the producer community that we will need to achieve our goals of modernization,” said NMPF President and CEO Jim Mulhern. “We’ve had many challenging conversations that were important to getting to a national consensus because of the regional nature of federal milk orders. But the give and take that’s needed to get to anything important done will place the entire industry on a sounder footing, creating a lasting benefit for all.”

NMPF, whose member cooperatives produce more than two-thirds of the nation’s milk, also welcomed Burnett Dairy Cooperative to its membership. Burnett Dairy Cooperative, based near Grantsburg, WI and founded in 1896, is one of the nation’s few remaining full-service cheese-producing cooperatives. It is a frequent winner at both national and worldwide cheese contests.

New directors elected to the Board of Directors and approved by NMPF delegates in 2022 include:

- Jeff Sims – Lone Star Milk Producers

- Kevin Ellis – Upstate Niagara Cooperative

- Cory Vanderham – California Dairies Inc.

NMPF also held its annual dairy contest in conjunction with the meeting. Ellsworth took the top prize, while a yogurt also took high honors in the first-ever inclusion of that category, in prizes awarded in the held in conjunction with NMPF’s annual meeting.

The NMPF Chairman’s Award went to Ellsworth Cooperative Creamery for their Pepperoni with Marinara Rub cheese, which achieved a 99.8 score. Agri-Mark received the Chairman’s Reserve Award for its 10% Vanilla Bean Greek Yogurt, which also won the award for best yogurt. Tillamook County Creamery Association earned the Best Cheddar award for its 2012 Makers Reserve, while Foremost Farms won the best Italian Cheese for its Mozzarella. Prairie Farms won the Best Cottage Cheese competition and also gained the most ribbons among co-ops participating in the contest, with 18.