Tag: dairy economics

FMMO Persistence Pays off for Farmers

- USDA’s recommended FMMO decision incorporates NMPF proposals

- Economics team member provided market outlooks and FMMO process updates across the country

NMPF’s Joint Economics Unit saw intense Federal Milk Marketing Order modernization in 2024, especially in the year’s earlier months. NMPF submitted its final legal brief to USDA in March, emphasizing that farmers are the reason the order system exists and that they should be the priority as USDA considers its final decision.

USDA released its recommended FMMO modernization plan July 1, agreeing in large part with the underlying principles of NMPF’s proposal. USDA’s biggest difference with NMPF was its establishment of a Class I mover for extended shelf-life products, which consists of the average of with an adjustable mover, even as most of the U.S. milk supply would revert to the “higher-of” formula in effect until 2019, as NMPF and its members advocated. NMPF-USDEC Joint Economics team members explain USDA’s recommended decision here.

Members of NMPF’s FMMO task force have reconvened to write comments on the recommended decision, which will be handed in by the Sept. 13 comment deadline for all stakeholders. USDA will review submissions and issue a final decision in November, followed by a producer referendum likely near the end of the year. Any changes will be implemented in early 2025, ending the formal FMMO modernization process.

Even as FMMO consumed team energy, members of the economics team traveled the country in 2024, providing expertise on changing market conditions throughout the year and updates on the FMMO modernization process.

Stephen Cain, senior director of research and economic analysis for NMPF, and Dr. Peter Vitaliano, vice president for economic policy and market research for NMPF, presented updates on the federal order modernization efforts to the NMPF Young Cooperators in February, the Southeast Milk Inc., Leadership Experience (SMILE) in May, and to the NMPF Board of Directors periodically. In August, Cain travelled to Detroit to update Michigan Milk Producers Association on the next steps in the process.

Producers were also updated on current and changing market conditions through 2024. Will Loux, senior vice president of global economic affairs for NMPF and USDEC, presented a domestic and export market outlook to South Dakota Dairy Producers in January and Dairy Farmers of America in July, as well as an update on the state of the dairy industry to the Idaho Milk Processors Association in August.

The economics team also met with the boards of United Dairymen of Arizona, Agri-Mark, Land O’Lakes, and Michigan Milk Producers Association to provide an update on Cooperatives Working Together renewal and modernization efforts. Cain and Dr. Vitaliano also provided outlook presentations for the National Ice Cream Mix Association annual meeting in January and to the American Butter Institute in April. Dr. Vitaliano also gave a butter-specific presentation to the joint American Dairy Products Institute-American Butter Institute annual conference in April.

Amid this backdrop, the dairy economy itself showed signs of improvement. The Dairy Margin Coverage Program, the main federal safety net for U.S. milk producers, saw its fourth highest ever margin in July, at $12.23/cwt, with the all-milk price at $22.80/cwt. End of August dairy and grain futures indicated that the DMC margin would average around $12.25/cwt for all of calendar year 2024.

Milk Prices and Margins Rise Despite Flat Aggregate Dairy Market Demand

Trust is a Dairy Superpower

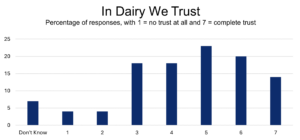

What makes dairy so valued that milk alone is in 94 percent of U.S. refrigerators? Nutrition is one factor. So is affordability. But perhaps the greatest value is one that data supports: People trust it.

The dairy checkoff’s latest consumer perception tracker, conducted by Kantar Group, shows just how much confidence dairy has from consumers – and it’s a great contrast to the loud braying of the anti-dairy fringe, which takes up more brain space among the sane and grounded than should. Rated on a 1-7 scale of trust, with 1 being none and 7 being total, 58 percent of consumers rated dairy at 5 or above, according to the nationally representative sample of consumers aged 13-65.

That same survey, conducted last November and December, showed 35 percent either strongly or completely trusting dairy, shown by ratings of 6 and 7. That high trust level held across generations. Baby boomers led at 38 percent of strong or complete trust; Generation X, a cohort famed for trusting no one, was lowest at 33 percent. And the future looks stable and bright. About 34 percent of teenagers strongly or completely trusted dairy, with young adults at 35 percent and Millennials at 36. And again, these were the highest ratings of trust – including less-fervent support, clear majorities spanned generations.

Dairy also did well when compared with other foods and industries. Dairy’s 58 percent trust level compares well with beef (53), almonds (51), tech (53, sorry Zuckerberg and Musk) and finance (43 – with apologies to Wall Street).

To sum up: In an increasingly fractured climate plagued by misinformation, dairy continues to attract broad-based support across wide swathes of society. In a superpower nation where trust is declining, dairy has its own superpower – trust from consumers that remains strong.

Pretty heavy stuff, when you think about it. But dairy can carry the load, with unparalleled nutrition, uncommon consumer reach and high levels of consumer trust. It’s a refreshing situation, appropriate for refreshing products.

June DMC Margin Gains $1.14/cwt to $11.66/cwt

The Dairy Margin Coverage Program margin in June was $11.66/cwt after adding $1.14/cwt over the previous month.

The June all-milk price was $22.80/cwt, up $0.80/cwt from May, and the DMC feed cost dropped by $0.34 for the month, mostly on a lower premium alfalfa price. The DMC margin calculated by USDA has risen $2.06/cwt over the past two months, reaching a level well above the threshold at which payments are generated by falling margins.

Futures-based forecasts at the end of July indicate that the DMC margin will average about $11.90/cwt during 2024, $0.40/cwt higher than similar forecasts indicated a month ago, with a peak in October, a sign that producers may have an opportunity to repair battered balance sheets over the next several months.

Supply-Demand Balance Pushes Milk Prices Higher

Dairy Data Delights, and Completes Your Summer Reading List

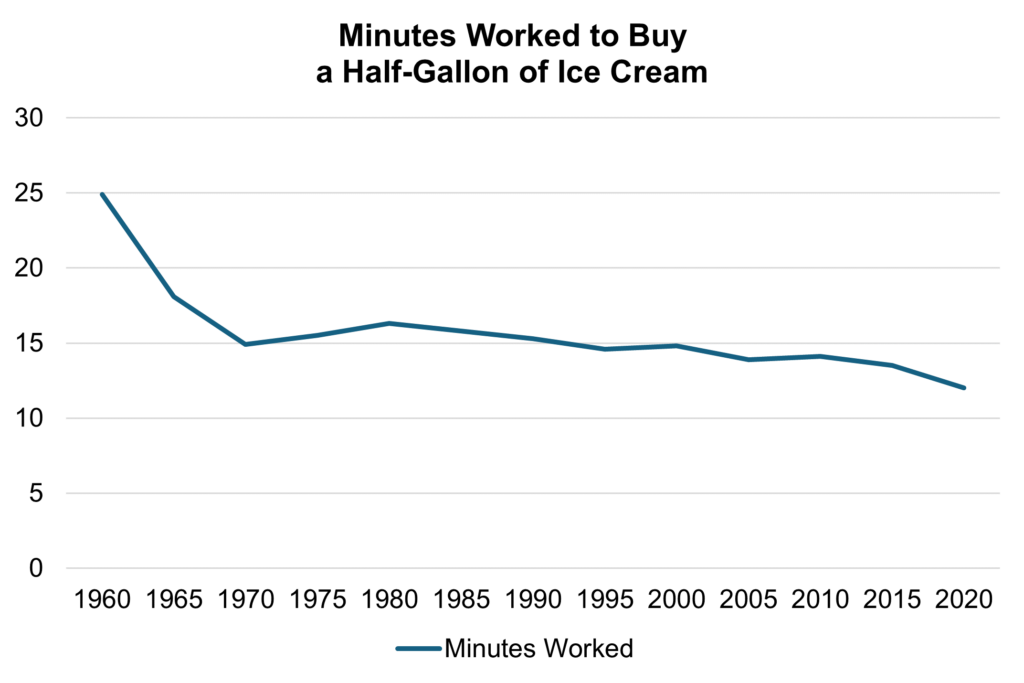

Impress your friends and dazzle your pub trivia team: Did you know that the average American worker only needs to work half as long to pay for a half gallon of ice cream as in 1960? Can you say, luxurious and affordable?

It’s in the numbers. Despite hourly wages that averaged $2.09 an hour the year John F. Kennedy was elected president (and both Joe Biden and Donald Trump were teenagers), the relative changes in wages and ice cream prices have made America’s favorite frozen dessert (Happy National Ice Cream Month) twice as affordable now, according to Labor Department data. What once took nearly 25 minutes of a U.S. worker’s hourly wage to buy takes less than 12 minutes now.

Butter holds a similar ratio, and whole milk and cheese affordability has also improved significantly. And still, some people long for the good old days.

You can find this information on page 85 of Dairy Data Highlights, a compendium of historical dairy statistics compiled by the NMPF/USDEC Dairy Economics Unit. The publication features facts on the evolution of farm sizes, milk production and dairy revenues, and the emphatic growth in the prominence of trade to the U.S. dairy economy. (Commercial dairy exports, 1985: 571 million pounds of milk equivalent. Commercial dairy exports, 2022: 40,581 million pounds.)

Suffice it to say, Dairy Data Highlights makes everyone’s summer beach reading list complete. And unlike current best sellers like “The Women,” or “On Call,” Dairy Data highlights is free – just download here.

That’s why the entire dairy community needs to know of this resource. See the rise in average herd sizes! Be wowed by the growth of processed gruyere exports! But mainly, know that this is out there. And use it as you need.

Fluid Milk Sales and Cheese Exports Surge Amid Production Decline

April DMC Margin Little Changed from March

The April Dairy Margin Coverage Program margin was $9.60/cwt, down by $0.05/cwt from March, just above the maximum $9.50/cwt maximum Tier 1 coverage level for the second month in a row.

The April All-Milk price dropped from March by $0.10/cwt to $20.50/cwt, and the April DMC feed cost calculation dropped by $0.15/cwt, on a $11/ton lower premium alfalfa hay price. Small changes in the corn and soybean meal prices offset each other on a per hundredweight of milk basis in the formula.

Available forecasts at the end of May indicate an increasingly high likelihood that the DMC margin will remain considerably above $9.50/cwt for the rest of the year.