- About

- Key Issues

Labor & Rural Policy

Sustainability

Animal Health

Nutrition & Food Safety

Labeling & Standards

- Programs & Resources

- Advocacy

- News

- Membership

- Events

- Stay Informed

- Contact

Larson Dairy, Inc.

Okeechobee, FL

Lower milk prices and higher production costs are leaving many dairy farmers with low—or non-existent—profit margins, making modernization to the Federal Milk Marketing Order (FMMO) Program critically important to farmers across the country.

But in some regions, without changes that put dairy farms on sounder financial and competitive footing, dairy itself may not have a future, said Florida dairyman Jacob Larson. Because without policy adjustments that encourage greater profitability, no other changes—not technological advancements, nor new approaches to cow care, or better investments in environmental practices—will matter to a dairy farm’s survival.

“If a farm is profitable, it most likely will continue,” said Larson, calling for a milk-pricing system “that is fair and equitable to the producers, the processors and the consumers.”

“Modernization has been needed for a long time and is overdue for an update.”

Jacob Larson and his brother Travis own and operate Larson Dairy, Inc., in Okeechobee, FL. It’s a proud family tradition. Larson’s grandfather, Red Larson, was instrumental in establishing the first federal milk marketing cooperative in Florida. Many years, and a merger, later, Larson Dairy, Inc. is still a member of Southeast Milk, Inc. Jacob serves as president of the cooperative and is the Southeast Milk representative for the NMPF Board of Directors.

Continuing his grandfather’s progressive legacy, Jacob Larson is embracing changes in dairy farming and advancing technology while championing milk-price reform to help ready his farm for the next generation. The main dairy is about 3,000 acres, where they milk 5,000 cows in two milking parlors, raise calves and heifers, and grow Bermuda grass for haylage.

Florida dairy is unique in many ways: The tropical climate isn’t ideal for cows. The shape of the state makes milk transport unusual. And the federal order covering Florida has the highest utilization of Class I fluid milk of any, making USDA’s current consideration of modernization especially critical for the state’s dairy farms.

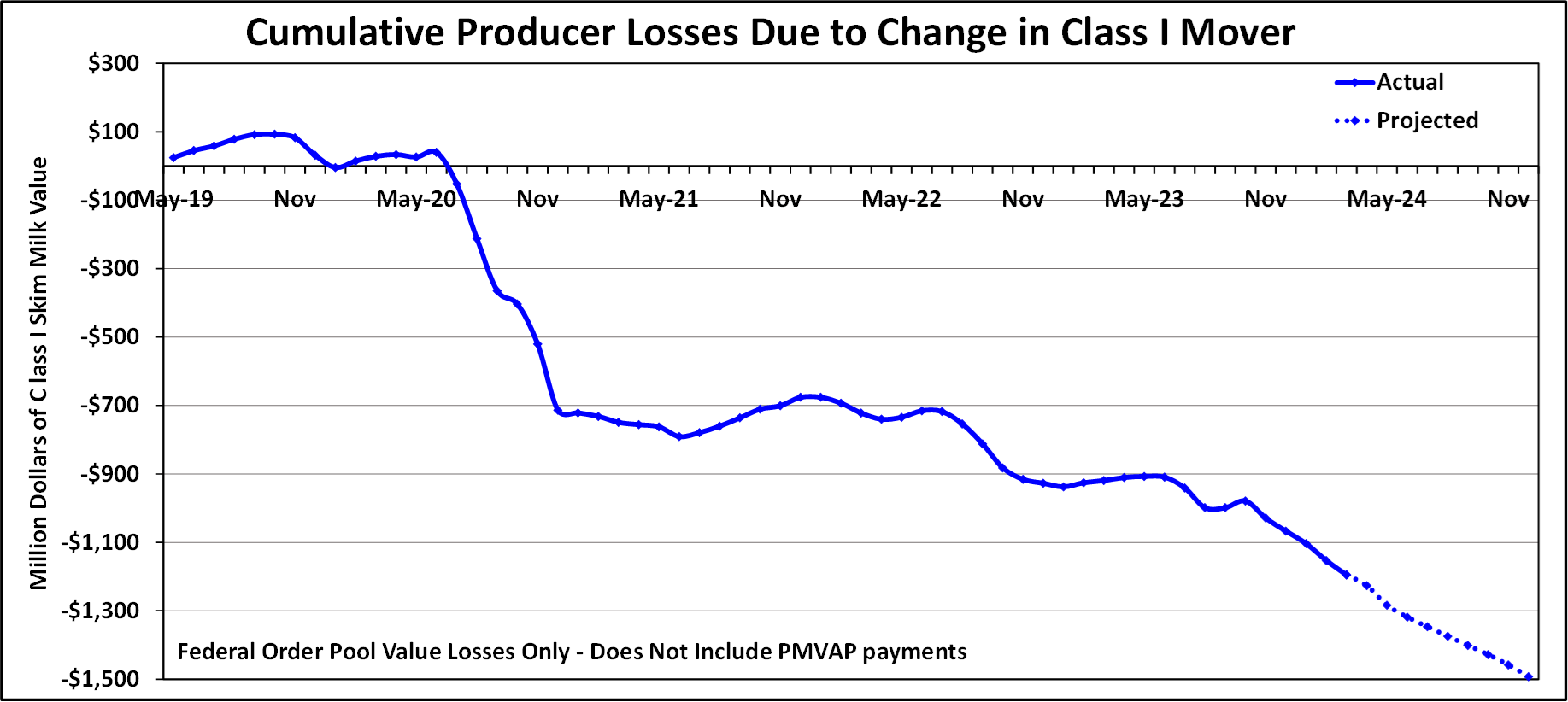

One aspect critical to Florida, Larson said, is returning to a system for setting the price of Class I fluid milk which used the “higher of” Class III and IV pricing, instead of an average. Since the 2018 Farm Bill changed the pricing formula, farmers are expected to lose $1.5 billion by November, based on NMPF analysis of USDA data. Continuing to operate at a loss like that is not tenable in fluid-heavy Florida, Larson said.

Another example is the Class I price differential, essentially a transportation allowance that’s become wildly out of date when applied to Florida traffic costs and travel patterns. The last major revamp of differentials in Florida occurred in 2008 (nationwide, the last update was in 2000), so changes in transportation costs and technology from previous decades simply aren’t reflected, he said.

The differential, Larson said, is “probably one of the most impactful or meaningful changes to this part of the geography of the United States.”

“The Class I price differentials have not equitably made up for the cost to move the inputs that we need to produce milk down into these regions,” Larson said. “When you look at what the federal order system is truly designed to do for consumers, it ensures that the local milk supply can move from the farm to the processors and into the hands of consumers. There’s about 9 million people living south of us, and our dairies in this Okeechobee area are the closest local fresh milk source to those processing plants and to those people.”

Being able to fairly compete for that market, Larson said, is a big part of why FMMO modernization is important. To be sure, a new pricing system doesn’t change the weather or the shape of the state; Federal Milk Marketing Order modernization “won’t ensure or guarantee profitability,” Larson said. But in a highly competitive, tight-margin environment, every penny counts just as much as every drop of milk.

“Even the best farmers will only deal with a very, very small margin of profitability for so long. If you have a 1% return versus a 5% return, how long does this generation or the next want to do that versus capitalizing on something else, another opportunity?”