|

|

|

|

By Allison Wilton, Coordinator, Economic Policy and Global Analysis, NMPF

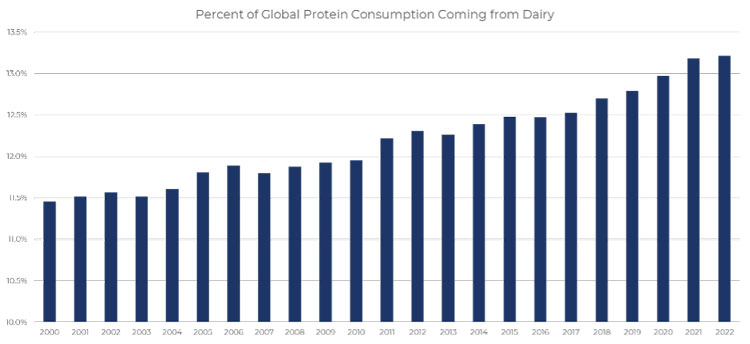

U.S. dairy consumption has been steadily rising for years, reaching more than 11.5 million metric tons (milk solids equivalent) in 2022. This is up 15% from ten years ago. As one of the highest dairy consuming countries in the world, U.S. per capita consumption of cheese, yogurt, and butter has grown steadily for years. Recent food trends are bringing fun and innovative twists on common dairy products; as examples, butter boards went viral last year as a new “charcuterie” option, and health influencers are raving about the benefits of adding cottage cheese into recipes for higher protein and healthy fats. Ultimately, dairy demand remains resilient even when facing significant headwinds.Dairy’s resiliency is true on a global basis, too. On average, 13% of the global consumer’s protein came from dairy in 2022, a rise compared to 2021 and a significant leap over the past decade. In fact, global dairy protein consumption has grown by nearly 25% over the last decade.

U.S. dairy consumption has been steadily rising for years, reaching more than 11.5 million metric tons (milk solids equivalent) in 2022. This is up 15% from ten years ago. As one of the highest dairy consuming countries in the world, U.S. per capita consumption of cheese, yogurt, and butter has grown steadily for years. Recent food trends are bringing fun and innovative twists on common dairy products; as examples, butter boards went viral last year as a new “charcuterie” option, and health influencers are raving about the benefits of adding cottage cheese into recipes for higher protein and healthy fats. Ultimately, dairy demand remains resilient even when facing significant headwinds.Dairy’s resiliency is true on a global basis, too. On average, 13% of the global consumer’s protein came from dairy in 2022, a rise compared to 2021 and a significant leap over the past decade. In fact, global dairy protein consumption has grown by nearly 25% over the last decade.

Still, despite that resiliency, inflation and economic uncertainty have affected consumers and the dairy industry.

Inflation had mixed effects

In 2022, consumers started to really take notice of rising grocery and food costs. Prices for goods across all categories, not just dairy, were starting to climb more than usual due to several factors, including the ongoing COVID-19 pandemic and international supply chain disruptions. Inflation reached a peak in summer of 2022, and though it has eased slightly since, prices are still significantly higher compared to three years ago.

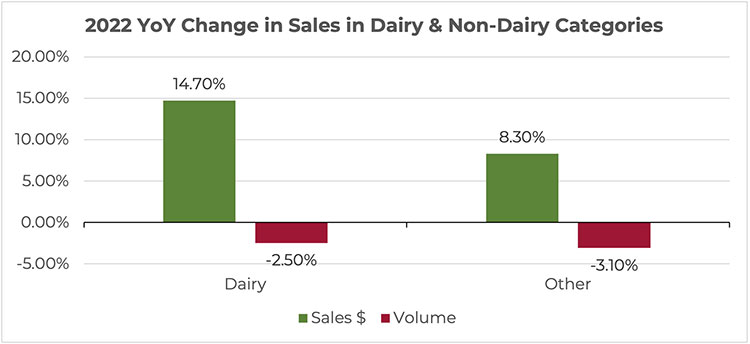

Source: NMPF-USDEC, IRI, NPD

Grocery and food items were some of the most prevalent and hardest hit areas by inflation, and dairy products were not immune. The price of dairy in food and beverage stores rose by more than 15% in 2022 compared to 2021, the highest jump in prices of all categories. The value of dairy sales grew significantly in 2022. Even so, and although this can partially be attributed to the higher prices, the growth in dairy sales (up 14.7%) outpaced that of non-dairy categories (8.3% greater).

Additionally, though all categories’ volume fell, the volume of dairy products sold fell less than that of non-dairy products. In other words: even though dairy had higher inflation rates, the slide in volume sold was less than the dip of other food and beverage categories. Shoppers were continuing to put dairy products in their cart despite the higher prices. That’s a testament to the dairy’s place as a dietary staple for many around the country and the world.

Dairy demand persists

Consumers prefer dairy products over plant-based alternatives: sales of cheese, frozen products, and other dairy goods dwarf plant-based imitations in stores. As even more alternatives fill shelves, dairy doesn’t lose shelf space. Rather, per capita consumption in several areas have grown, including cheese (up 17% from 2020), yogurt (up 5%), and butter (up 21%). The dairy aisle remains of top value when compared to other aisles within major food and beverage stores and is one of the fastest growing aisles in terms of sales dollars, topping $75 billion in 2022.

Cheese is expected to grow only more popular as time goes on, as is butter and yogurt. The U.S. dairy industry is poised to meet this demand as the industry advances in the coming years. As inflation wanes, consumers may return to trying higher value dairy products, of which there is no shortage. U.S. dairy will continue to be a major part of consumers’ diets and shopping carts.

This column originally appeared in Hoard’s Dairyman Intel on Nov. 9, 2023.

NMPF’s senior vice president Chris Galen discusses the upcoming 2023 NMPF annual meeting starting Nov. 12 in Florida.

CWT member cooperatives secured 63 contracts in October, adding 5.4 million pounds of American-type cheeses, 844,000 pounds of cream cheese and 388,000 pounds of whole milk powder to CWT-assisted sales in 2023. In milk equivalent, this is equal to almost 59 million pounds of milk on a milkfat basis. These products will go to customers in Asia, Central America, the Caribbean, Middle East-North Africa, South America and Oceania, and will be shipped from October 2023 through April 2024.

CWT-assisted 2023 dairy product sales contracts year-to-date total 41.7 million pounds of American-type cheese, 908,000 pounds of butter, 26,000 pounds of anhydrous milkfat, 7.8 million pounds of cream cheese and 39 million pounds of whole milk powder. This brings the total milk equivalent for the year to 751.6 million pounds on a milkfat basis.

Exporting dairy products is critical to the viability of dairy farmers and their cooperatives across the country. Whether or not a cooperative is actively engaged in exporting cheese, butter, anhydrous milkfat, cream cheese, or whole milk powder, moving products into world markets is essential. CWT provides a means to move domestic dairy products to overseas markets by helping to overcome U.S. dairy’s trade disadvantages.

The amounts of dairy products and related milk volumes reflect current contracts for delivery, not completed export volumes. CWT will pay export assistance to the bidders only when export and delivery of the product is verified by the submission of the required documentation.

NMPF strongly objected to FDA’s discussion of plant-based milk and yogurt alternatives in the agency’s draft guidance ,“Questions and Answers About Dietary Guidance Statements in Food Labeling: Draft Guidance for Industry” published by the Food and Drug Administration (FDA) in comments submitted Sept. 25.

Dietary guidance statements can be used on food labels to provide consumers with information about foods or food groups that can contribute to a nutritious dietary pattern to help consumers make healthier choices. NMPF’s comments supported the use of consensus statements from authoritative bodies as the basis for dietary guidance statements but requested clarification on food group equivalents. NMPF also questioned FDA’s approach to plant-based milk and yogurt alternatives, saying it will encourage false and misleading advertising — which FDA has already acknowledged as an issue in their draft guidance for the labeling of plant-based milk alternatives.

“Despite the agency’s instructions to use consensus statements from authoritative bodies in developing guidance statements, FDA appears to violate its own principle by describing a means by which plant-based alternatives other than fortified soy could make dietary guidance statements based on consensus statements about the dairy group,” NMPF wrote in its comments.

NMPF’s comments on the proposed guidance for dietary statements is one small part of the organization’s broader campaign against the mainstreaming of plant-based beverages as legitimate dairy alternatives, an issue FDA itself has acknowledged is a public health threat. Other efforts include our campaign for a stricter version of FDA’s draft guidance on plant-based beverage labeling, multiple letters to the agency, and a Freedom of Information Act request on agency communications regarding plant-based beverages.

The American Butter Institute’s (ABI) Board of Directors reviewed and approved a USDA proposal to allow for greater industry participation in butter testing at its fall conference in Phoenix, Oct. 5-6.

ABI, an industry group managed by NMPF, worked with NMPF regulatory staff to respond to an August proposal from USDA’s Agricultural Marketing Service (AMS) that would allow butterfat tests to be performed at an in-house or approved third party laboratory, and add a requirement for plants to maintain and make such records available for examination by a USDA inspector. ABI’s response supported the amendment as a means of increasing butter processing efficiency that conforms to current industry practice. ABI’s members also sought further clarification from USDA about which tests will be reviewed, suggesting that only finished product tests should be considered.

ABI’s letter to USDA, signed by NMPF Chief Counsel Clay Detlefsen, who also works for ABI under the management arrangement, also proposed that butter manufacturers take the lead in performing grading services in their own facilities, following the procedures set forth by USDA. Under this new approach — also discussed at the fall conference by ABI’s board — USDA could then audit those records to ensure manufacturer compliance with USDA grading procedures and allow the finished goods to use the USDA grade shield.

ABI will continue to speak with USDA about how to shift more grading practices to member companies’ facilities.

NMPF’s incoming CEO and a member of its executive committee shared their insights on agricultural policy, while the FARM Program connected with producers and the National Young Cooperators (YC) Program promoted young and diverse dairy farmer voices at the World Dairy Expo.

Current NMPF Chief Operating Officer Gregg Doud and Pete Kappelman of Land O’Lakes discussed the prospects for farm bill passage and the ins and outs of federal risk management programs on a panel at Expo on Oct. 5. Meanwhile, the National Dairy FARM Program connected with farmers and industry leaders through its booth at the trade show all week and hosted an informational session the same day.

The FARM Program’s presence at World Dairy Expo each year offers an opportunity for FARM Program staff to share program updates face-to-face, and to receive feedback from producers and FARM Program evaluators. This year, FARM staff shared important updates about the upcoming Animal Care Version 5 launch next July, upcoming changes to Environmental Stewardship in Version 3, details about the recent FARM Biosecurity — Enhanced Program, the impact of the Workforce Development Program, and participation data across all program areas.

The YC Program hosted a panel discussion facilitated by Uplevel Dairy Podcast’s Peggy Coffeen, “The Eight Questions that Will Move Your Dairy Farm Forward,” on Oct. 5 at the World Dairy Expo in Madison, WI. Three young dairy farmer leaders participated in the panel including Wisconsin dairy farmers Paul Lippert, a Foremost Farms member owner, Laura Raatz, a Land O’Lakes, Inc. member owner, and Nathan Wiese, a member owner of Farm First Dairy Cooperative.

Panelists discussed how they are positioning themselves for long-term success by answering eight key questions related to culture, sustainability and profitability. More than three dozen YCs from seven member cooperatives participated in the session and reception later that day.

The National YC Program co-hosted a Tanbark Talk the next day with the Dairy Girl Network exploring the leadership challenges women encounter as they navigate careers in the dairy industry and prepare for future success. The conversation was facilitated by the Dairy Girl Network’s Laura Daniels and panelists included Lorilee Schultz, a Prairie Farms member owner and chairperson of the National YC Program, Julie Mauer, a Land O’Lakes Inc. member owner, Dairy Farmers of America’s Mary Knigge and Rita Vander Kooi, an Associated Milk Producers Inc. member owner.

NMPF and USDEC urged the U.S. Trade Representative to take action to resolve pressing trade barriers including tariff discrepancies and disputes with Canada and other countries in Oct. 23 comments submitted for the agency’s annual National Trade Estimate Report.

The report is designed to catalogue key barriers impacting U.S. exports and prioritize USTR efforts to address them. NMPF emphasized the importance of exports to the health of the U.S. dairy industry and reiterated its concern that the administration has chosen to put less energy into pursuing free trade agreements that open new markets for U.S. dairy products.

NMPF listed the specific major trade barriers confronting the U.S. dairy industry on a country-by-country basis in key markets, including:

The U.S. Department of Agriculture announced Oct. 23 it will direct $1.3 billion from the Commodity Credit Corporation (CCC) to establish a Regional Trade Promotion Program, and another $1 billion to commodity-based international food aid, after significant lobbying from NMPF and encouragement from the U.S. Dairy Export Council.

The funding announcement was prompted by a Sept. 6 letter from Senate Agriculture Committee Chair Debbie Stabenow, D-MI, and Ranking Member John Boozman, R-AR, calling on the agency to expand CCC authority to fund export promotion and food aid initiatives. NMPF has long advocated for Congress to double funding for the Market Access Program and Foreign Market Development program, which significantly advance U.S. dairy’s reach overseas but have not received a funding boost in more 16 years. This U.S. investment will help bridge the gap in export promotion funding that U.S. agriculture receives in comparison to foreign competitors.

The 2018 Farm Bill’s lapse Sept. 30 is the first step in a cascade of expirations that includes key dairy programs ending Dec. 31, making year-end passage of a new farm bill a critical priority for dairy farmers and the cooperatives they own.

NMPF is seeking timely passage of a farm bill that:

While disputes regarding government funding and House leadership have held off farm-bill movement, the committees are working diligently and in a bipartisan manner to be ready to move bills across the floor at the earliest possible opportunity. Discussions continue regarding ways to meet a variety of funding requests, including on commodity and trade programs.

Passing a farm bill this year is a top priority for NMPF; still, an extension must be enacted at a minimum if a new bill is not finished. The Dairy Margin Coverage safety net lapses Dec. 31 if it is not either reauthorized or extended. Further, no action by New Year’s Day would trigger the “dairy cliff”, whereby 1940s-era permanent law would kick in and trigger very high price support levels for numerous commodities, including dairy. While the dairy cliff has always been more of a prod to congressional action than an imminent threat, due to the new rules that would need to be written and the timeline for implementation, the result would be much higher milk prices in the short term. However, NMPF remains confident that Congress will prevent these lapses, as has happened during each farm bill process previously.

NMPF advocacy and assistance paid off for farmers in October, as organization efforts encouraged the U.S. Department of Agriculture first to offer, then to extend the application deadline for critical, long-awaited financial assistance for dairy farmers affected by natural disasters.

The Milk Loss Assistance Program administered by the Farm Service Agency is compensating eligible dairy farms and processors for milk dumped due to qualifying disaster events in 2020, 2021 and 2022, including droughts, wildfires, hurricanes, floods, derechos, excessive heat, winter storms and smoke exposure. It’s designed to help farmers and, in certain cases, cooperatives, recover losses previously overlooked by disaster assistance.

After announcing the program, which was created in a coronavirus assistance bill but delayed by rule-writing, in early October, NMPF urged USDA to extend its signup deadline to Oct. 30, giving farmers more time to participate. NMPF, which helped individual farmers and member cooperatives navigate the program, said in a news release and on social media that it appreciated USDA’s action, offering additional details to help members in a Member Alert.

“We are grateful to USDA for giving dairy farmers extra time to enroll in the Milk Loss Program,” said Jim Mulhern, president and CEO of NMPF, in a news release. “This essential program will compensate producers for milk dumped due to disasters over several years. This extension will allow farmers more time to prepare their applications and fully benefit.”

The Dairy Margin Coverage (DMC) margin in September rose rapidly from August, as markets have been anticipating for months. The margin was $8.44/cwt for the month, rising $1.98/cwt over August, which itself was up almost $3 from July’s record low of $3.52/cwt.

As with the August increase, September’s DMC margin rise was driven primarily by a higher all-milk price, which rose by $1.30/cwt over August to hit $21.00/cwt. The September DMC feed cost formula shed $0.68/cwt, due mostly to a lower corn price, with a smaller drop in the September soybean meal price partially offset by a small rebound in the price of premium alfalfa hay.

The September margin will generate $1.06/cwt payments to $9.50/cwt DMC Tier 1 coverage. The futures markets are currently expecting the DMC margin to hover around that maximum coverage level each month during the fourth quarter of the year.