Let’s say it plainly: Exports are critical to the future of U.S. dairy, and dairy cooperatives that point themselves toward benefiting from exports will gain additional opportunities to thrive. That’s why one of NMPF’s most important projects this year is rethinking and renewing its Cooperatives Working Together program. CWT has played a major role in boosting U.S. dairy exports and increasing milk prices for all producers in recent years. It promises to become even more significant in the future as its reach and resources potentially expand.

For those less familiar with the program, here are the basics: It’s a voluntary, marketing-focused program managed by NMPF and funded by CWT participating member cooperatives that boosts U.S. dairy product sales and strengthens relationships with overseas customers by helping participating cooperatives weather the ebbs and flows of international markets. Increasing overseas sales helps U.S. producers grow new markets. It also helps them sell products abroad that otherwise would stay at home, which better aligns supply and demand for everyone, regardless of where their milk is marketed. And by pooling resources to build member exports, CWT is a classic example of the self-help cooperative spirit in action.

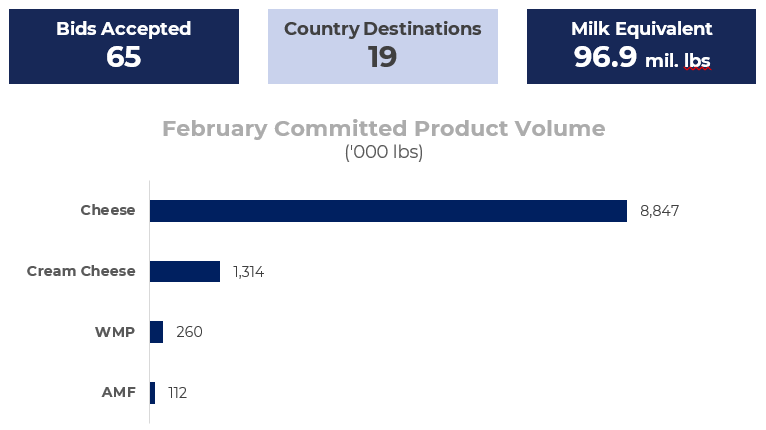

Trade is the central way U.S. dairy producers have been able to find markets for production that’s grown faster than U.S. mouths can consume it: 17 percent of U.S. milk is now being shipped overseas in some form, up from 13 percent in 2010. CWT has significantly assisted that expansion. Last year, despite global economic challenges and sluggish international demand, CWT member cooperatives secured 553 contracts overseas, representing 58.4 million pounds of American-type cheeses, 1.1 million pounds of butter, 46,000 pounds of anhydrous milkfat, 39 million pounds of whole milk powder and 9.1 million pounds of cream cheese. In milk equivalent, that equals 922.1 million pounds on a milkfat basis.

Other than cheese, every product included in CWT saw its volume of sales supported by the program increase in 2023, including a 73 percent gain in butter and a 27 percent jump in whole milk powder. CWT-supported sales also reached more countries than the year before, thriving both in places where the U.S. is establishing itself as a reliable partner and in new destinations where CWT has encouraged buyers to take a closer look at U.S. dairy. All of this shows how CWT is a proven winner for U.S. dairy, one that, even in challenging years, shows growth and greater potential.

That’s where we stand, heading into a pivotal year for the program.

CWT is renewed every three years, and 2024 is a renewal year in that cycle. We have exciting opportunities this time around to enhance CWT’s export assistance program, including expanding the number of products supported. We have also initiated conversations about how CWT could help member sales through means other than providing direct export support, such as providing logistical, manufacturing and marketing support. To generate ideas and assess the merits of various innovative proposals, we’ve convened a task force of experts from our cooperatives to identify what the collective investment in CWT can achieve.

Membership is open to any dairy cooperative – most, but not all, members are part of NMPF – and its business benefits outweigh its membership costs. Every cooperative has good reason to join: Larger, established co-ops can use export assistance to solidify and expand sales and markets, while co-ops less acquainted with the international arena can use CWT to help them break in, knowing they have the backing of an established, successful way to reach foreign markets.

CWT can help co-ops keep their bottom lines healthy, and they can provide impetus for expansion. It’s been helping everyone in dairy for years by encouraging demand that lifts the entire industry, driven by the cooperatives who effectively use it.

As this conversation unfolds, we’re both interested and eager to gain input that both improves CWT’s value for current members and encourages new ones to join. Cooperatives Working Together gives its members an advantage in facing dairy’s future, and it’s an important asset to the entire industry. We’re excited to see where we can take it in its next chapter. Thank you for any help you can provide.

Gregg Doud

President & CEO, NMPF