The final numbers are in, and they confirm what we’ve anticipated all year. In 2023, consumers emphatically turned away from plant-based beverages at an accelerating rate that caused the category to lose market share to milk, where whole milk and lactose-free varieties are thriving and surpassing their competitors.

The numbers give even more reason to put a stake in all that overprocessed hype – and to push even harder for integrity in labeling beverages that are being abandoned by consumers tired of inferior alternatives to dairy.

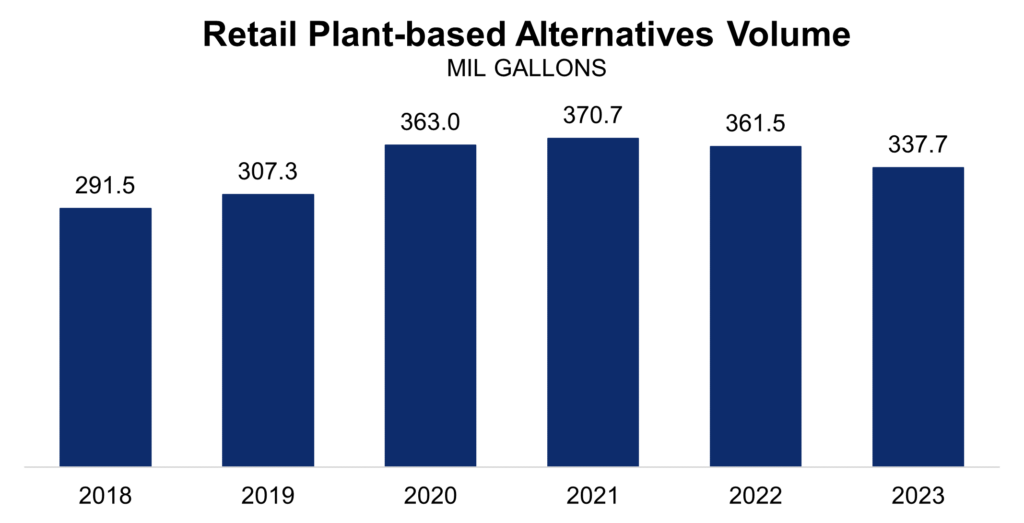

With full year data now available from Circana Inc., which tracks grocery-store spending, plant-based beverage consumption in 2023 fell 6.6 percent to 337.7 million gallons. It’s the second straight year of declines and the lowest consumption since 2019.

Sales volumes for almond drinks, the biggest plant-based category, fell 10 percent, and the soy beverages that vegan activists weirdly want in school lunches declined 8 percent. Even the once-Next-Big-Thing, oats, only rose 1.4 percent last year.

Sorry, Oatly – the froth has left your latte, and all that’s left is the drain.

Meanwhile, fluid milk – the real kind – keeps chugging away. To be fair, like plant-based, its consumption also declined, and like plant-based, its sales volume number starts with a 3. However, that 3.137 is followed by the word billion – not million, which is where plant-based is stuck – and the drop was 2.7 percent, less than half the rate of decline for plant-based beverages. That means fluid milk last year lengthened its lead over plant-based. In 2022, fluid milk had 89.9 percent of the pie. In 2023, it rose to 90.3 percent.

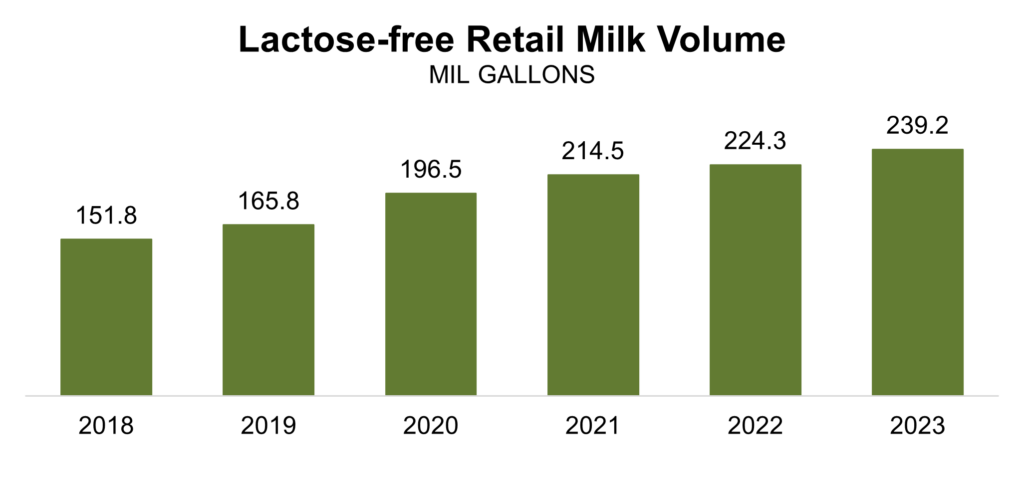

Beyond the overall number, fluid milk had more good news. Sales of whole milk, the most popular variety (and the one we need back in schools), rose last year, and lactose-free milk – the one tailor-made for people with dairy sensitivities – jumped 6.7 percent to 239.2 million gallons. With that, lactose-free milk surpassed almonds; it’s now a bigger category on its own than any plant-based alternative.

(You’ll hear a lot about that in the next year. We’ll make certain of it.)

The idea that milk was losing market share because consumers were turning to plant-based alternatives was always off-base. Now, it’s just a lie. And the decline of plant-based beverage isn’t likely to be an aberration: Once the initial hype is gone, and the sustainability claims are debunked, and the nutrition fallacies are exposed, what, exactly, does over-processed sugar water have going for it?

Oh, right, their misleading labels.