By Jaime Castaneda, Executive Vice President, Policy Development & Strategy, National Milk Producers Federation

By Jaime Castaneda, Executive Vice President, Policy Development & Strategy, National Milk Producers Federation

Exports are critical to America’s dairy farmers and processors. Last year, the American dairy industry exported $8.1 billion in dairy products, roughly 17% of total U.S. milk production. That’s the second-best year on record, falling just short of 2022.

As global demand for high-quality and sustainably-produced dairy products will grow, the U.S. dairy industry must keep exports expanding to thrive today and over the long term. To help encourage that, and in the absence of efforts by the U.S. government to secure new market openings, the National Milk Producers Federation (NMPF) and the U.S. Dairy Export Council (USDEC) have taken the initiative to drive forward projects to pursue Most-Favored Nation (MFN) tariff reductions in multiple key export markets.

U.S. dairy’s quarter-century of export expansion hasn’t been by chance. The strong commitment from U.S. dairy producers and manufacturers to investing in painstakingly growing international sales, coupled with multiple trade agreements that opened the door for that growth to occur, are key drivers of the trend. Unfortunately, in recent years, anti-trade rhetoric has gained momentum from politicians on both sides of the aisle. Meanwhile, major competitors — namely in Europe, Australia, and New Zealand — have successfully negotiated new market access, advantaging their domestic producers through lower tariff rates and favorable trading conditions. The result is that U.S. producers are increasingly at a disadvantage in several key markets, including China and most countries in Southeast Asia.

MFN tariffs are tariff rates that one country applies to imports from all trading partners that are members of the World Trade Organization. Importantly, MFN tariffs do not apply to products that benefit from even lower rates due to preferential trade agreements, such as a free trade agreement or customs union.

Not content to yield key markets to trade competitors, NMPF and USDEC launched a formal initiative in 2014 to lower duties on U.S. dairy exports in China. Following years of engagement, that resulted in a tariff cut on U.S. cheese exports. A few years later in 2019, NMPF and USDEC’s efforts scored another breakthrough by securing tariff reductions on a variety of exported dairy products into Vietnam.

Halfway around the globe, NMPF and USDEC tallied a small victory in March by successfully petitioning the United Kingdom government to eliminate its 6% tariff on fat-filled milk powder for at least two years.

NMPF and USDEC are continuing to pursue MFN tariff cuts in other key markets around the globe as well, with an emphasis on the growing Asian region, even as government initiative is lacking.

For example, the Philippines is a sizable dairy importer, using those inputs in the Philippine food processing and food service sectors. NMPF and USDEC have impressed upon the Philippine government the advantages of diversifying its dairy supply chains further and are petitioning for MFN tariff reductions for a variety of products, including cheese, lactose, and milk powder.

Although these initiatives by NMPF and USDEC cannot fully replace government negotiation of new trade agreements, efforts to drive down tariffs in these countries represent just a few examples of the markets that NMPF and USDEC are prioritizing as they continue to fight for fair opportunities for U.S. dairy producers and companies to compete in the global market.

This column originally appeared in Hoard’s Dairyman Intel on April 4, 2024.

We’ve had a lot of achievements this year, but it’s also been a challenging time.

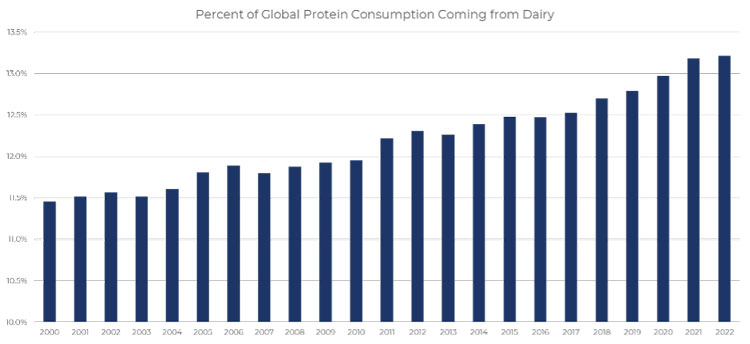

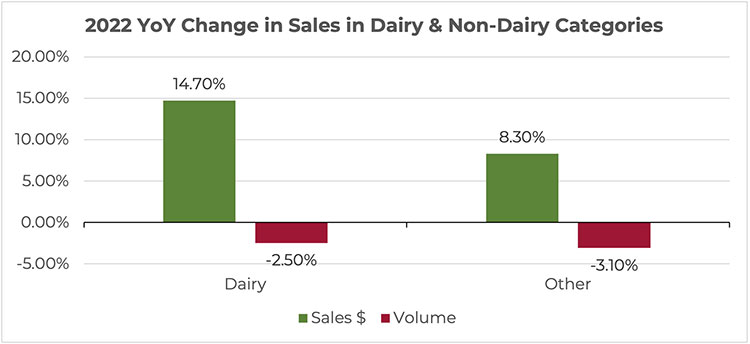

We’ve had a lot of achievements this year, but it’s also been a challenging time. U.S. dairy consumption has been steadily rising for years, reaching more than 11.5 million metric tons (milk solids equivalent) in 2022. This is up 15% from ten years ago. As one of the highest dairy consuming countries in the world, U.S. per capita consumption of cheese, yogurt, and butter has grown steadily for years. Recent food trends are bringing fun and innovative twists on common dairy products; as examples, butter boards went viral last year as a new “charcuterie” option, and health influencers are raving about the benefits of adding cottage cheese into recipes for higher protein and healthy fats. Ultimately, dairy demand remains resilient even when facing significant headwinds.Dairy’s resiliency is true on a global basis, too. On average, 13% of the global consumer’s protein came from dairy in 2022, a rise compared to 2021 and a significant leap over the past decade. In fact, global dairy protein consumption has grown by nearly 25% over the last decade.

U.S. dairy consumption has been steadily rising for years, reaching more than 11.5 million metric tons (milk solids equivalent) in 2022. This is up 15% from ten years ago. As one of the highest dairy consuming countries in the world, U.S. per capita consumption of cheese, yogurt, and butter has grown steadily for years. Recent food trends are bringing fun and innovative twists on common dairy products; as examples, butter boards went viral last year as a new “charcuterie” option, and health influencers are raving about the benefits of adding cottage cheese into recipes for higher protein and healthy fats. Ultimately, dairy demand remains resilient even when facing significant headwinds.Dairy’s resiliency is true on a global basis, too. On average, 13% of the global consumer’s protein came from dairy in 2022, a rise compared to 2021 and a significant leap over the past decade. In fact, global dairy protein consumption has grown by nearly 25% over the last decade.