Author: Theresa Sweeney

Dairy Farmers Descend on Senate to Demand Agriculture Labor Reform

Dairy farmers from National Milk Producers Federation member cooperatives and state dairy associations are visiting U.S. Senate offices today and tomorrow as part of a fly-in calling for an agricultural labor bill that could be reconciled with a plan the House approved last year, providing the stable, secure labor force U.S. dairy producers need.

U.S. dairy producers face labor shortages that are more intense than those felt in agriculture as a whole because they cannot use the H-2A farmworker program, which only provides for seasonal labor rather than the year-round workers dairy needs. With domestic workers in short supply and foreign labor difficult to employ under current policies, dairy farmers are urging lawmakers to find real solutions.

“The situation is dire,” said Jim Mulhern, president and CEO of NMPF, the biggest U.S. dairy-farmer organization. “Dairy farmers face labor shortages while they are forced to navigate the deeply uncertain and volatile realities undergirding agriculture labor in the U.S. Meanwhile, uncertainty on the farm harms individuals and rural communities that rely on those farms to generate jobs.”

The House of Representatives in December passed bipartisan legislation allowing for year-round visas in dairy as part of the first ag-labor bill to pass that chamber since 1986. NMPF supported the bill, noting that, although imperfect, its passage was a necessary step in moving toward a legislative solution addressing the ag labor crisis, with further work to be done in the Senate to improve upon the House measure.

The fly-in is taking place after the conclusion of NMPF’s March Board of Directors meeting held in Arlington, Virginia. During the board meeting, NMPF officially expanded its membership with the addition of Cayuga Marketing, LLC based in Auburn, NY, adding an important upstate New York voice to NMPF’s work on behalf of all dairy producers. NMPF also endorsed dairy-sector sustainability efforts during its meeting, lauding industrywide plans to reduce carbon emissions to net zero.

Dairy Farmer Testifies Before House Subcommittee on Importance of Expanding Exports Opportunities and Fair Rules

Connecticut dairy farmer, James “Cricket” Jacquier, testified today before the House Committee on Agriculture’s Subcommittee on Livestock and Foreign Agriculture in order to provide a dairy stakeholder perspective on agricultural trade. Jacquier is Chairman of the Board for Agri-Mark, a dairy cooperative comprised of 850 farm families across New England and New York. Agri-Mark is a member of the National Milk Producers Federation and the U.S. Dairy Export Council, which work together to advance dairy trade policy for the industry.

In his testimony, Jacquier urged Congress to work with the Administration to use negotiating resources wisely to target important agricultural markets and create greater access for U.S. dairy products with key trading partners. He noted that careful and proactive attention to the implementation and enforcement of negotiated trade agreements, such as USMCA, will be critical in the coming year, emphasizing in particular the importance of ironing out details pertaining to new export access and Class 7 related dairy policy reforms with Canada, and common cheese name safeguards with Mexico as USMCA progresses.

Regarding GIs, Jacquier also raised concerns with the European Union’s (EU) efforts to misuse geographical indication to instead confiscate common food names, such as parmesan, feta and asiago, as well as wine and meat terms.

“America’s dairy farmers applaud the certainty that lowered tariffs and fairly negotiated trade agreements bring to our industry. However, if we cannot combat outrageous nontariff barriers, such as those the EU is manufacturing to block the export of American-made cheeses, these trade wins can ring hollow. The EU’s stance on common food names is a protectionist and anti-trade policy and it must be firmly rejected by Congress and by U.S. trade officials at every turn,” Jacquier said.

Dairy farmers, manufacturers and rural communities rely on the economic benefits provided by dairy exports. In 2019, America’s dairy industry exported more than $6 billion in dairy products ranging from cheese to ice cream to milk powders. Trade disputes and a lack of market access comparable to our competitors has significantly harmed the dairy industry, contributing to a 15% decline in dairy farms over the past two years, according to U.S. Department of Agriculture data.

You can find Jacquier’s submitted testimony here.

Dairy Defined: Lactose-Free Milk is Growing Faster Than Plant-Based. You Didn’t Know That?

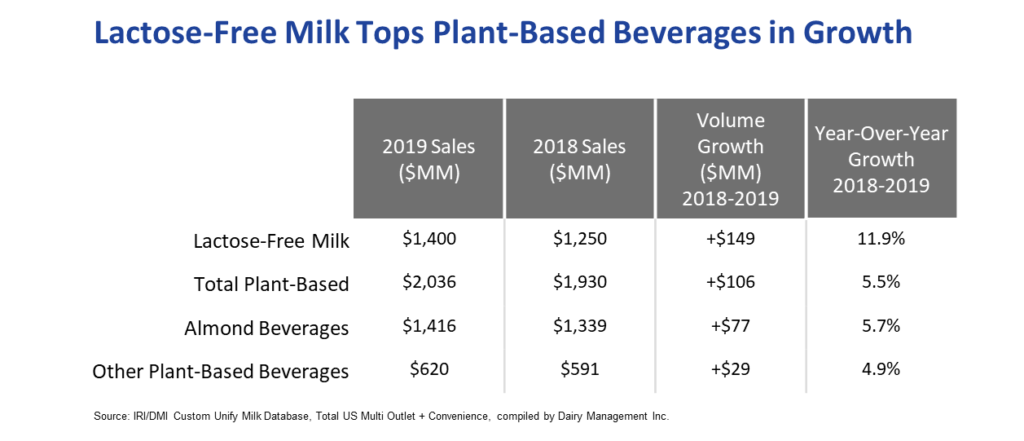

ARLINGTON, Va. – This might be tough to digest if you’re a plant-based fundamentalist, but the numbers don’t lie: In 2019, lactose-free milk sales grew twice as fast as plant-based beverages, with lactose-free poised to surpass almond-beverage sales this year.

How could this be, given the hyperbole about dairy’s decline and the rise of plant-based beverages? Well…

Contrary to some portrayals, the dairy sector is full of innovation, and lactose-free is a prime example of how dairy is addressing per-capita drops in fluid-milk consumption. Dairy categories increasing their sales, including whole milk (now more than two-fifths of consumer sales), lactose-free milk and flavored varieties, are giving plenty of reason for optimism about the future of milk. Meanwhile, plant-foods companies are “innovating” by figuring out which nut or seed to run through the grinder next. Soybeans, then almonds, then oats, and then … if past is prologue, pecans and pistachios are probably getting nervous.

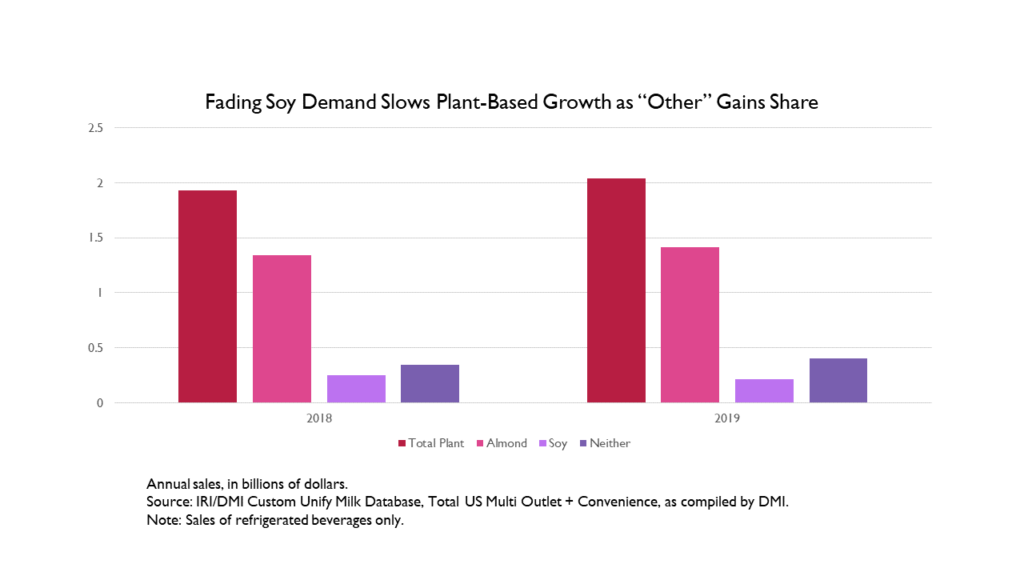

This isn’t to suggest that some plant-based beverage sales aren’t growing. Indeed, some categories are rising quickly, but they’re growing from a tiny base.

Breaking it down further: Almonds, with about three-quarters of sales, drive the plant-based beverage category. And almond-beverage sales are growing (although not as fast as lactose-free milk). Among plant-based beverages that aren’t almonds, soy is #2. But soy is declining, in 2018 by more than 13 percent from $248 million to $215 million, a percentage drop much greater than any sales decline in dairy. (We’re still waiting for the “Death of Soy” articles to be written, by the way.) Oat-based beverages are growing fast –an eye-popping 872 percent in 2019. But that will be impossible to sustain given its an incredibly small base: $7 million in 2018 to $68 million in 2019.

Meanwhile, Americans bought $13.88 billion of milk in 2019, down from $13.93 billion (we had to use extra digits because both round to 13.9). Size and scope, people. Size and scope.

So again – why does the plant-based-rising-as-dairy-declines narrative even exist? Because upstarts need to cast themselves as innovators — even as their “innovations” use a lot of water and offer questionable nutrition – to justify the marketing and refrigerated shelf-space budgets spent to convince consumers they’re the Next Big Thing. Many of them pay slotting fees to enter the dairy case and call themselves “milks” – a category in which, nutritionally, they don’t belong. And they do that because the FDA lets them – which, given the FDA’s own labeling rules, they shouldn’t.

New and small vs. old-and-big is an ancient narrative – but miscast narratives, however easy to repeat, impede accuracy, and in this case, public health too. The growth of categories like lactose-free milk, greater innovation within dairy, contrasted with the growth-to-plateau-to-decline of some plant-based products (cashews, rice, hemp and hazelnuts – all saw sales drop last year) are all fresh, under-covered narratives.

The numbers are there. It might be worth a look.

CWT assisted sales in February total 9.8 million pounds of dairy exports

CWT assisted member cooperatives in securing 75 contracts with sales of 3.6 million pounds of American-type cheeses, 862,008 pounds of butter, 4.6 million pounds of whole milk powder and 745,163 pounds of cream cheese. The product is going to customers in Asia, Central and South America, the Middle East, North Africa and Oceania. The product will be shipped during the months of February through July 2020.

These transactions bring the 2020 total of the CWT-assisted product sales contracts to 4.896 million pounds of cheese, 1.190 million pounds of butter, 5.291 million pounds of whole milk powder and 1.390 million pounds of cream cheese. These contracts will move the equivalent of 121.5 million pounds of milk on a milkfat basis overseas in 2020.

Assisting CWT member cooperatives to gain and maintain world market share through the Export Assistance program, in the long-term expands the demand for U.S. dairy products and the U.S. farm milk that produces them. This, in turn, positively impacts all U.S. dairy farmers by strengthening and maintaining the value of dairy products that directly impact their milk price.

The amounts of dairy products and related milk volumes reflect current contracts for delivery, not completed export volumes. CWT will pay export assistance to the bidders only when export and delivery of the product is verified by the submission of the required documentation.

All cooperatives and dairy farmers are encouraged to add their support to this important program. Membership forms are available at http://www.cwt.coop/membership.

USDA Ag Sustainability Framework Will Further US Dairy Sustainability Efforts

At its annual outlook conference in February, the USDA announced a new Agriculture Innovation Agenda intended to improve the productivity and reduce the environmental footprint of farming in the coming decades. Agriculture Secretary Perdue said that the Innovation Agenda is a department-wide initiative to align resources, programs, and research to increase farm output by 40%, while reducing by half the environmental footprint of U.S. agriculture by 2050. This effort will focus on cutting nutrient runoff and carbon emissions, reducing food loss and waste, and increasing renewable energy production and use.

The USDA’s outline for achieving those sustainability targets are aligned with U.S. dairy sustainability goals. This will help leverage what the dairy producer community is already focused on through our collective efforts in the Innovation Center for US Dairy’s Environmental Stewardship goals, Newtrient, the Net Zero Initiative, and the FARM Program’s Environmental Stewardship module. These efforts are all designed to continue the global leadership of the U.S. dairy industry in environmental stewardship through voluntary efforts by dairy farmers through market-based incentives.

In a related development, NMPF joined with a coalition of farm organizations this week to announce the formation of Farmers for a Sustainable Future. Part of the mission of this group, which also includes the American Farm Bureau, the National Farmers Union and the National Council of Farmer Cooperatives, is to help set the record straight about the impact of farming and food production on the environment. It’s no secret that cattle farming in particular receives a disproportionate amount of blame for its greenhouse gas emissions, when our own dairy lifecycle assessment indicates that milk production is less than 2% of the national total. Fortunately, the dairy sector is well-positioned as a leader in American agriculture in addressing sustainability issues and harnessing resources to further mitigate our environmental footprint.

NCIMS Posts Dairy Inspection Documents

After months of work, the National Council on Interstate Milk Shipments posted two documents regarding the Dairy Inspection Pilot Program on Feb. 24. The pilot program began last month and will run until December in nine participating states. The pilot program offers two options for the inspections:

- Establish a federal-state partnership in which individual states co-regulate all non-Grade “A” products processed in Interstate Milk Shipment-listed facilities located in the state. During the check rating, the Milk Specialist will verify the state has adequately covered the non-Grade “A” PC requirements which will then count toward the federally mandated limited scope PC inspection or;

- All IMS- listed facilities receive and Appendix T audit by an FDA Milk Specialist on the check rating interval.

The pilot offers a chance to explore options to achieve inspectional efficiencies between the Pasteurized Milk Ordinance (PMO) and Food Safety Modernization Act (FSMA).

In 2018, FDA tried back-to-back inspections, first a PMO inspection, followed by an FSMA inspection. Plant personnel described that as an overwhelming experience and NMPF urged the FDA not to conduct inspections that way in the future. Once the pilot is completed, FDA and the NCIMS Liaison Committee will assess the pilot outcomes and present the findings at the 2021 NCIMS conference. NMPF is pleased with the outcome of the partnership between the NCIMS Liaison Committee and FDA in getting the pilot program up and running.

FARM Environmental Stewardship Begins Version 2

FARM Environmental Stewardship officially transitioned to ‘Version 2’ at the end of February, updating its greenhouse gas and including new data points.

Accompanying the new version of FARM ES will be an updated User Guide and an online training to be released before the end of Q1.

The three main categories of major changes coming in FARM ES Version 2 include new data options and questions, new crop emissions factors that update baseline information, and more detailed results, such as the ability to see greenhouse gas results broken down by type of gas.

If previous data under the first version of FARM ES represents a coop/processor ‘baseline’ of GHG emissions, FARM recommends and is able to re-run the old data using Version 2 of the model. Typically, GHG reporting guidance recommends re-running the ‘base year’ of data if methodology updates will significantly impact results. In such cases, the crop emissions factors updates do change the ‘feed production’ portion of the GHG emissions. Participants who choose not to re-run baseline data should note in any external GHG reporting that subsequent years were calculated using different methods than the baseline year.

NMPF Takes Aim at Misuse of GIs

With the European Union (EU) continuing its aggressive campaign to confiscate common food names at the expense of American dairy farmers and consumers, NMPF is backing U.S. government efforts to defend U.S. exports.

The federal government over the past year defended American-made exports via approval of USMCA and through incorporating new safeguards for common names in its Phase One negotiations with China. During recent meetings with European agriculture and trade officials, Agriculture Secretary Sonny Perdue made it clear that the EU must drop its GI agenda in order to successfully negotiate a trade deal with the U.S.

However, NMPF is urging the U.S. government to more proactively posture confront this issue to preserve market access, protect American jobs and defend the legitimate rights of food manufacturers, farmers and exporters. NMPF joined with USDEC and CCFN to issue a joint statement Jan. 30 applauding Secretary Perdue’s commitment to protecting common names. “As Secretary Perdue rightly noted, Europe’s unfair trade barriers have less to do with preserving the rights of legitimate GIs than with restricting competition from exceptional U.S. products,” the statement said. “Dismantling EU trade barriers that drive the dairy deficit and cause undue harm to our industry must remain a top priority in negotiations with the EU.”

NMPF and the U.S. Dairy Export Council (USDEC) also raised the issues of GIs in a joint statement submitted to the USTR touting support for a detailed accounting of global GI barriers submitted by the Consortium for Common Food Names (CCFN) in response to USTR’s call for input to inform its annual Special 301 report on intellectual property issues.

NMPF is an active member of CCFN, which works to dismantle trade barriers that prevent the U.S. dairy industry from selling common-name cheeses abroad. CCFN’s comments lay out concerns regarding the misuse of GIs on a country-by-country basis, focusing on the EU’s push to use GIs to block U.S. exports.

NMPF Proactive Toward USMCA Implementation

As the U.S. government now turns its attention towards implementing and ratifying the U.S.-Mexico-Canada Agreement, NMPF is encouraging the U.S. Trade Representative (USTR), working in concert with other parts of the USMCA implementation team including at the U.S. Department of Agriculture (USDA), to clearly outline U.S. expectations for how USMCA dairy provisions are implemented.

The forward-leaning posture, necessary to prevent bad-faith actors from undermining the full intent of USCMA’s dairy provisions, was signaled Feb. 27 NMPF joined with the U.S. Dairy Export Council (USDEC) in a letter to USTR and USDA outlining specific provisions that should command the administration’s dedicated attention. The provisions included: reforms to Canada’s dairy pricing policies; administration of Canada’s TRQs; and safeguards that protect U.S. companies’ rights to use common food names in Mexico.

These messages also were emphasized during recent in-person meetings NMPF held with USTR staff, Mexican industry and government officials and Canadian officials to discuss the importance of collaboration and good-faith implementation of USMCA to avoid trade disruptions. NMPF is continuing its work alongside government officials and industry stakeholders to ensure USMCA’s provisions are implemented and enforced in good faith.

Dairy Tracking Key China Trade Developments

NMPF, the U.S. Dairy Export Council (USDEC) and dairy allies in China are working both to solidify gains represented in the “Phase One” China trade deal that went into effect Feb. 14 and to advance beyond them by fostering the removal of all retaliatory tariffs on dairy.

The agreement, which includes pledges from China to step up its buys of U.S. agricultural goods, holds the potential for U.S. dairy exports to expand. However, still-in-place tariffs may curb those purchases relative to other farm products.

The tariff front saw a positive development March 2 when China’s Tariff Committee of the State Council opened a process for companies registered to conduct business in China to apply for exemptions from retaliatory tariffs still in effect. The process, intended to help fulfill China’s purchasing agreements under Phase One, may boost sales of skim milk powder, whey products and lactose, all among the products for which China specifically invited tariff exemption. Applications for additional products are permissible as well, according to China’s announcement of the program.

In addition to their efforts to lift retaliatory tariffs, NMPF, USDEC and the Consortium for Common Food Names (CCFN), sent a letter Jan. 27 to Ambassador Lighthizer and Secretary Perdue expressing support for the gains made in the China Phase One deal while noting the need to hold China accountable for its commitments made on facilities audits and listings, product registrations, and common food names.

The U.S. Trade Representative has established a Bilateral Evaluation and Dispute Resolution Office to oversee China’s compliance with the agreement. NMPF and USDEC are also actively monitoring China’s adherence to its Phase One commitments as coordinated enforcement efforts between the dairy industry and government partners will be key to ensuring that China upholds its trade obligations.

DMC Margin Drops in USDA Projections

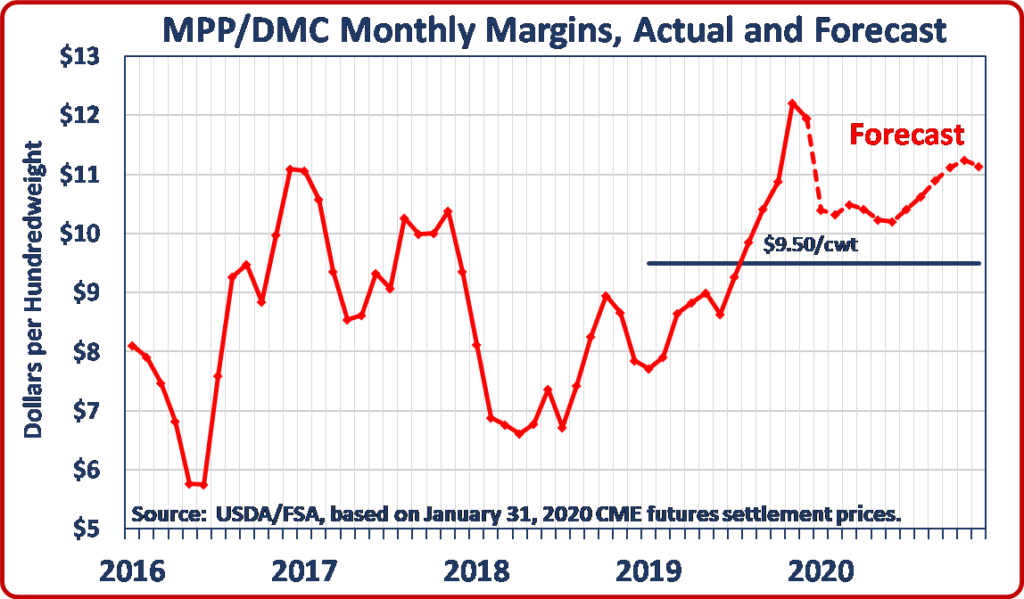

A combination of rising supplies and fears of lower demand due to the coronavirus worsened the economic outlook for U.S. dairy producers, with margins under the Dairy Margin Coverage program falling.

The January 2020 Dairy Margin Coverage margin was $10.72 per cwt., a drop of $1.23 per cwt. from the December margin, according to USDA data. This drop was the combined outcome of a $1.10 per cwt. lower all-milk price and a $0.13 per cwt. higher calculated DMC feed cost for January, compared with a month earlier. The January margin was $0.27 lower due to the incorporation of dairy-quality alfalfa in the DMC feed cost formula, which began in 2019.

At the end of February, USDA’s DMC Decision Tool, which can be accessed online, projected the DMC margin would drop sharply for the first several months of 2020 and fall below the $9.50 per cwt. coverage level for April through August. Based on that forecast, coverage at that level would pay an average of $0.18 per cwt. for all of 2020, which was above both the one-year and the 5-year discounted costs of that coverage.

As of Feb. 18, USDA reported that 13,024 dairy operations, or 47.71 percent of operations with production histories, had enrolled in the 2020 DMC program. Many of these enrollees are operations that signed up for 5-year coverage last year. Enrolling in the DMC program at the generous coverage and affordable premiums available will always be a highly recommended risk-management option for dairy farmers, and this year is a case in point. Just a month ago, the USDA DMC Tool indicated that the DMC margin would not drop below $10.00 per cwt. anytime during 2020 and thus would generate no payments during the year.

The DMC information page on NMPF’s website offers a variety of educational resources to help farmers make better use of the program. NMPF also posted a new video explaining how farmers can benefit from the DMC.