This just in: The sun rose today, people argued over politics … and consumers keep fleeing from plant-based beverages.

That final statement is becoming so obvious that it wouldn’t be worth writing about anymore – if people paid enough attention. But given the strength of misinformation in 2025, let’s say it again: Plant-based beverages are losing market share to milk, as in real, recognizable-to-your-grandmother, dairy-from-a-mammal milk. The 2024 retail data is in. And here’s what the trend shows.

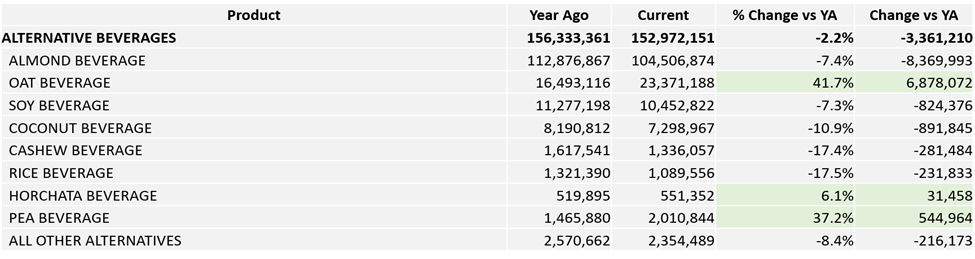

According to Circana, which tracks retail sales scans, milk’s sales volume relative to plant-based beverages rose again in 2024, with its relative share now at its highest since 2019. While milk consumption stayed essentially flat, plant-based beverage consumption fell for its third consecutive year, with almond and soy continuing to fall and oats going nowhere. Check out that trend, below.

What does it all mean?

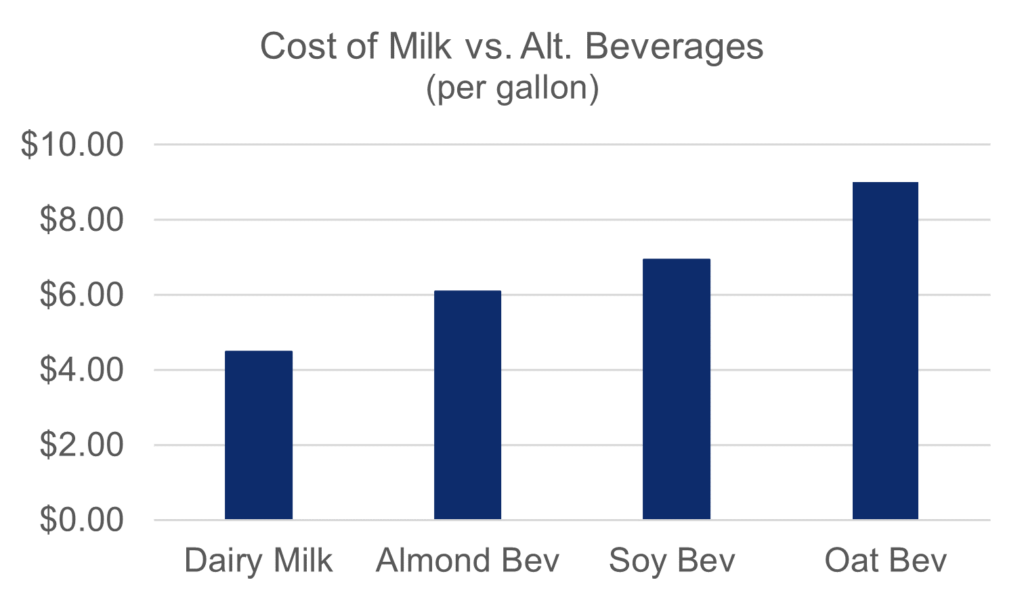

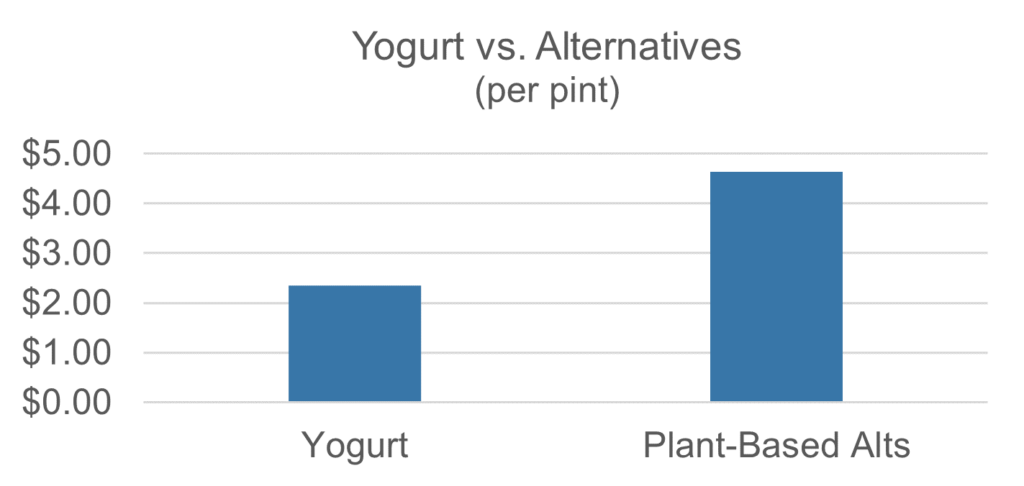

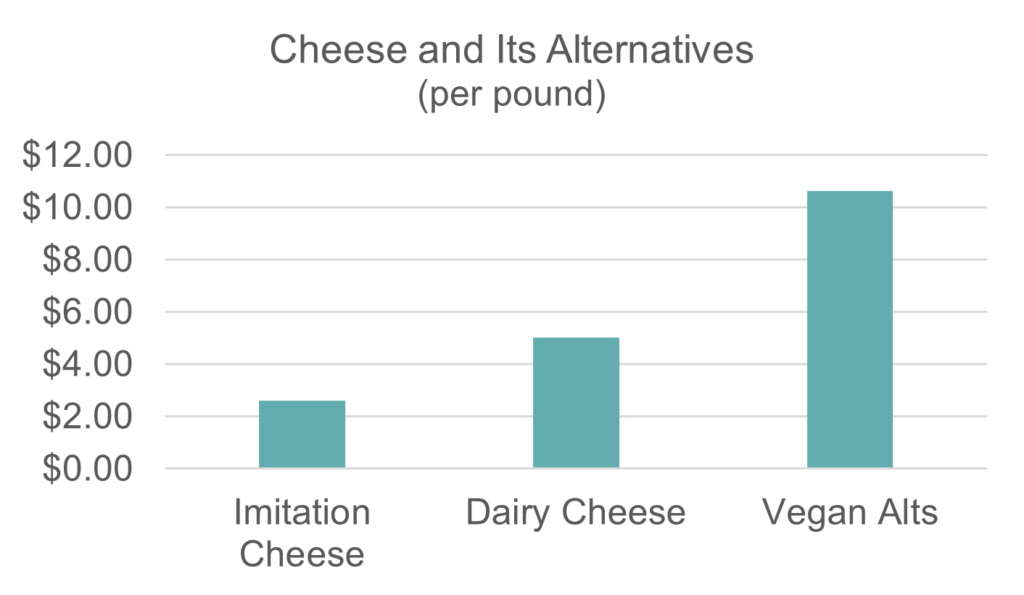

It likely means that consumers are continuing to catch on to the misleading arguments of plant-based beverage purveyors. It means that people who are seeking truly healthy, sustainable products are rediscovering dairy. It also means that the government should catch up to the people it serves by encouraging healthy choices through enforcing its own standards of identity for dairy terms and making it clear that plant-based alternatives don’t provide the nutrition consumers expect from milk.

But even though all the above is true, we’d answer that question with one word: Sanity. After decades of dishonest marketing and open disregard for FDA rules, truth and healthy nutrition are winning. And dairy farmers are happy to keep that positive trend going, by providing the world’s most perfect beverage, one that’s increasingly chosen over the dishonest knockoffs.

Raise your glass, and many more. It’s the increasingly popular thing to do.