First, the bad news (for consumers): Heading into the holiday baking season, butter prices are, indeed at an all-time high. That’s for a few reasons. The biggest one is simple demand. Americans love butter, with the highest per capita consumption since the 1960s leading to the highest overall demand ever for the nation’s pre-eminent spread and ubiquitous baking ingredient. Overseas markets are also getting in on the act, with another record year for dairy trade possible in 2022.

Meanwhile, butter supplies haven’t, as of yet, been able to keep up with that demand enough to stabilize prices. That’s especially been the case in the past couple months, when retailers traditionally stock up in anticipation of the holidays. And of course, once you get past the actual cost of making butter itself and then add transportation, packaging, labor, and all the other the costs that are making everything else more expensive too, you have a recipe for record butter prices on the grocery shelf. And that’s making consumers (and media) notice.

But are higher prices the same thing as a “shortage”? We posit, not. Are store shelves empty? There’s always some one-off instances somewhere, but with those exceptions, no. Are crowds of consumers lining up for blocks outside local supermarkets to buy out rationed supplies, like early-COVID toilet paper? (Everyone stand six feet apart, please!) No again. And is anyone who wants to buy butter currently being deprived of anything other than $5 should they choose a four-pack, maybe a little extra if it’s extra-creamy European Style?!?? (And often less is you catch a good sale.)

That’s three strikes, and still, no one’s out of butter.

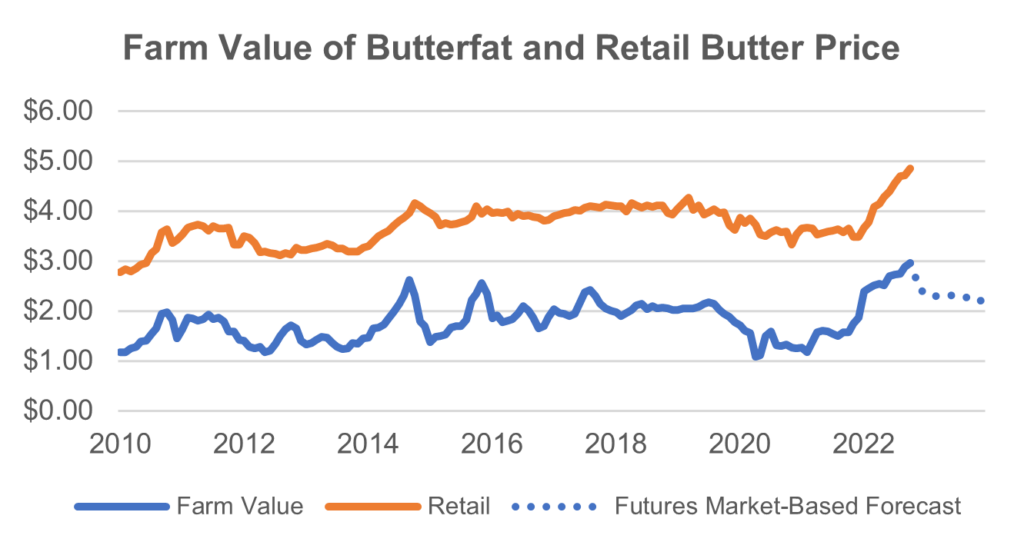

It’s easy to understand the concern: Butter is, after all, nature’s most perfect sandwich spread, the ingredient that makes a top-quality croissant worthy of a nasal-sounding French pronunciation. And even with all this, the underlying concern that’s fueled the “shortage” worries is itself showing signs of fading. Milk production is on the rise again, and with that, butter futures traded on commodities markets are declining. While some product prices rise and stay that way, butter goes up and down. Take a look at this chart — a dozen years of butter-price history that includes both the value of butterfat to a farmer (blue line) and the cost at the grocery store (orange line). See how they move together – and see where the blue line’s expected to go in 2023.

“What goes up, must come down” applies to butter. Production chases prices, and eventually higher production pushes prices down. That’s not always so great for farmers, by the way – and one nice thing for them about current pricing is that it’s helping farmers smooth out a challenging few years and rebuild the balance sheets they need to thrive. So be patient if you’re feeling sticker shock, and in the meantime, feel good that you’re helping a farmer.

But above all, don’t feel like you’re at risk of a butterless Christmas. The food chain, and the law of supply and demand, are ensuring that doesn’t happen. The holidays would be less happy without butter, but it just ain’t gonna happen. So Happy Thanksgiving. And here’s to, um, butter days ahead.