Dairy Defined:

The Numbers Don’t Lie – Plant-Based Beverages Losing Market Share to Milk

July 24, 2023

Attention to everyone who values accuracy over propaganda: The next time you read a news article that states “milk is losing market share to plant-based alternatives,” please send the reporter, the editor, anyone who will listen, a link to this column.

Because any reputable news organization corrects fact errors – and as of this year, that statement, long accepted as the “inevitable” outcome of “innovation,” is no longer true. In the beverage marketplace, milk isn’t just beating plant-based on nutrition, price, overall sales and consumption volume – it’s increasing its market share too.

First, the bad news. Milk’s growing relative strength isn’t because people are drinking more of it. Even though fluid milk continues to outpace fake milk sales by nearly nine to one, consumption is down this year, like it has most every year since baby boomers left elementary school and all types of beverages, not just plant-based alternatives, multiplied in number and further segmented the beverage market. Through July 9 – just over halfway through 2023 – fluid milk retail sales volume (overwhelmingly cow’s milk, with just a pinch of goat milk for an animal-based alternative) was 1.62 billion gallons, down 3.4 percent from the year-earlier period, according to research firm Circana Group, which objectively reports sales figures via bar codes and is the retail industry standard for grocery-sales data.

Wish it weren’t true, but … but …

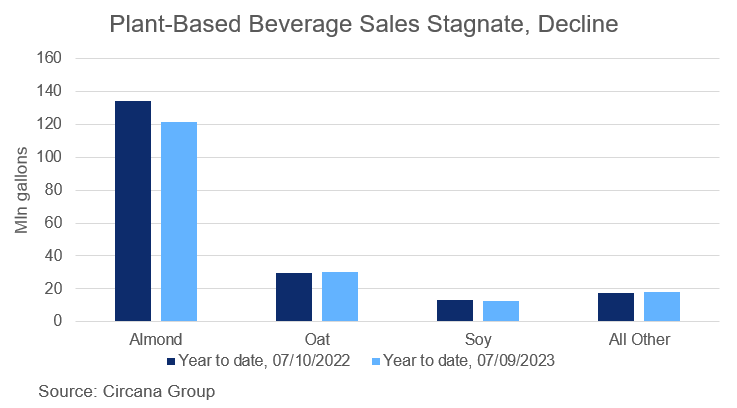

But how does that compare to the “dairy alternative” universe – the one where heavily processed, over-priced nut juices are marketed as healthy, climate-conscious “milks”? The one where dishonest marketers crow about how fake milks are on the rise while boring ole’ actual milk is a thing of the past? Year-to-date, they’ve sold 182 million gallons of the stuff, a number that’s down … um … you read it here first … 6.6 percent from one year ago. Because plant-based consumption is falling even faster, true dairy milk is extending its already dominant lead. So far this year, real milk holds 89.9 percent of the total milk-and-fake-milk market, up from 89.6 percent last year.

Tough to get your brain around? That’s understandable – false narratives are difficult to dispel. But the truth will set you free – and it tastes better, too.

Maybe consumers are figuring out that overpriced, under-nourishing flavor-of-the-month beverages weren’t the next frontier after all. Digging into the stats further: Almond drink, the darling of the 2010s, is still the plant-based category leader, but down 9.4 percent so far this year from a year ago. Oat beverages, the recent Next Big Thing, is up an anemic 1.8 percent – maybe because top peddler Oatly’s marketing antics are starting to leave a taste in people’s mouths that’s almost as bad as their product’s.

And soy-based beverages – the ones vegan advocates want in the federal school lunch program – are down 7.4 percent this year, even as the most popular milk variety, whole milk, also is kept out of school lunches because foolish ideas and bad science die hard. That would be funny, if it weren’t so sad that whole milk, an obvious solution to nutrition and food waste problems in federal meals, gets short shrift in comparison to soy due to vegan ideology.

Maybe the “innovation” pitch was a lie all along. In many ways, nothing is new under the sun, or in the grocery aisle. Marketers and manufacturers have been taking water, adding stuff to it, bleaching it white and calling it “milk” for centuries. The latest scheme is admittedly less deadly than previous ones — but with doctors reporting malnourished children fed vegan “milk” by duped parents, it still has a real public health cost. That’s why dairy farmers have been calling on FDA to enforce its own standards of identity for decades, to largely deaf (though recently a little bit less deaf – or maybe we’ve just been louder) ears from the agency.

To be sure (and for clarification), all these statistics are based on consumption volume – what people actually drink – than sales values, the preferred measure of advocates for plant-based beverages that are more expensive than true dairy. By that measure, plant-based beverage sales are still up 5.8 percent year-to-date, compared to dairy’s decline of 1.2 percent. But that’s not because plant-based beverages are becoming more popular – it’s because they cost 9.2 percent more than a year earlier, compared to milk’s 2.2 percent. Isn’t inflation a magical thing? Even so, we expect that marketers will use that cherry-picked value to prop up the tired Death of Dairy narrative – and credulous journalists will pick up on it to justify their inaccurate articles.

Don’t let them do that. The numbers don’t lie – plant-based beverage consumption is on the decline, and claims otherwise are disingenuous. Keep this in mind as you watch for misinformation. Feel free to share this data to stop it.