DMC Margins May Not Reflect True Dairy Losses, Even as They Plunge

May 1, 2020

With the coronavirus crisis massively disrupting dairy demand and supply chains, margins under the Dairy Margin Coverage (DMC) program fell dramatically in March and April. Even so, they may not accurately reflect the true losses producers are facing due to the unusual effects of the crisis on milk-component prices, a public-policy concern as USDA allocates billions of dollars in emergency assistance.

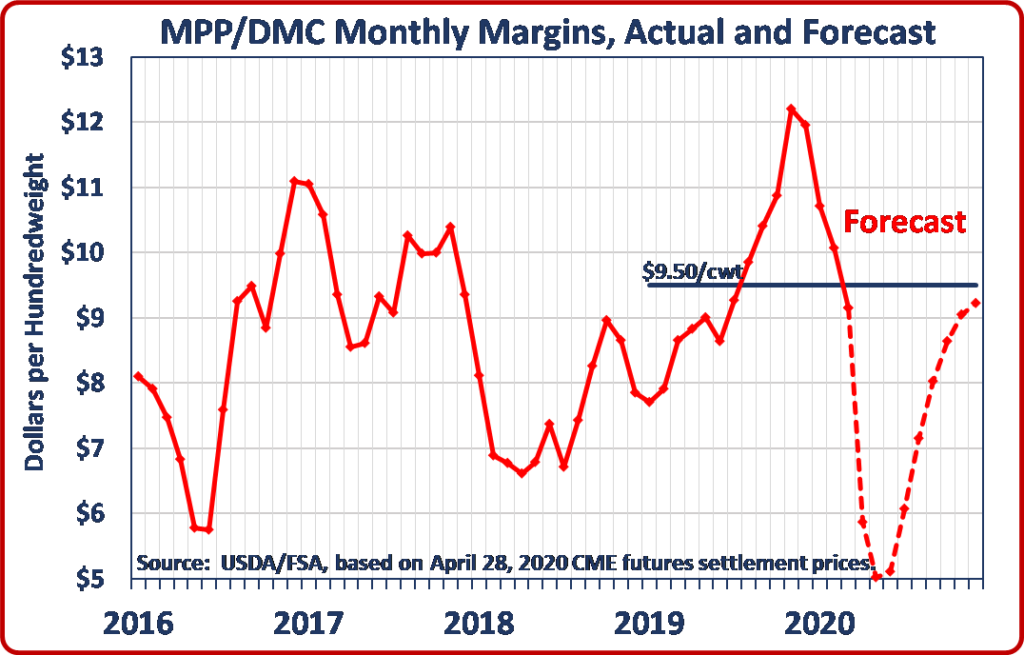

The DMC margin for March was $9.15 per cwt., 35 cents below the $9.50 per cwt. maximum coverage level for the program. The situation has deteriorated further in April: The full-year margin as of the April 28 forecast by USDA’s DMC Decision Tool, shown in the chart, was forecast to be $7.69, $1.81 per cwt. below the $9.50 trigger. Farmers enrolled in the program at all coverage levels, both under and over 5 million pounds of production history, would collectively receive $515 million in government payments at that margin.

Still, even margins that low – the lowest since 2009, if current margin formulas were projected backward – may understate the full loss for dairy.

Under normal circumstances in the U.S. dairy industry, the NASS-reported all-milk price used for DMC calculations behaves as what can be termed a commodity milk price. This means that, although it is determined using a survey methodology, it closely tracks the prices of the four basic dairy products: butter, cheddar cheese, nonfat dry milk and dry whey. These product prices determine federal milk marketing order class prices, which in turn determine order blend prices, which have a strong influence on prices paid to all dairy farmers. Futures prices for the four commodities can be used to forecast the all-milk price when that price effectively behaves as a commodity milk price. This happens when milk supply and demand are in reasonable balance, virtually all milk sold is processed, very little milk is sold at distressed prices, and producers whose milk is pooled on federal orders receive close to the federal order blend.

None of that has been true in recent weeks, making the issue of what the all-milk price reflects a key factor in allocating billions of dollars in payments to dairy farmers under the DMC and, potentially, under the Coronavirus Food Assistance Program (CFAP) this year. This year, dairy farmers will get little to no payment for large volumes of dumped milk, and additional large milk volumes will be sold at seriously distressed prices, none of which is reflected in a commodity milk price.

The forecast of the U.S. average all-milk price during calendar year 2020 released last month by USDA’s World Agricultural Outlook Board in the April 9 World Agricultural Supply and Demand Estimates (WASDE) report appears to recognize this issue. The forecast, $14.35 per cwt., was about $2.00 per cwt. lower than commodity milk price forecasts were indicating at the time, and the report further commented that its forecasts included “additional milk marketed but not processed”, i.e., dumped milk.

The Decision Tool’s milk price forecasts are essentially commodity milk price forecasts. If the reported all-milk prices over the next several months also account for the milk prices dairy farmers actually received, payments as determined under USDA loss calculations would be much larger.

The DMC margin calculation is required by law to use the NASS-reported all-milk price. The CFAP direct payment calculations for dairy currently being formulated by USDA will involve estimating the prices that would have been received by dairy farmers if the coronavirus pandemic had not occurred, which would be commodity milk prices because the assumed scenario would be basically normal industry conditions. Still, such a scenario should be compared with prices received under the current crisis conditions, which will not be commodity milk prices.

Although commodity prices, and hence commodity milk prices, have fallen as a result of the pandemic, actual prices received by dairy farmers will have fallen even more. If these calculations use the NASS all-milk price, it will be important that they reflect this difference. It will be critically important to see if NASS takes its cue from the interagency experts who made the April WASDE forecast when it reports the all-milk price for April a month from now.

The DMC information page on NMPF’s website offers a variety of educational resources to help farmers make better use of the program.